Standard Deviation indicator

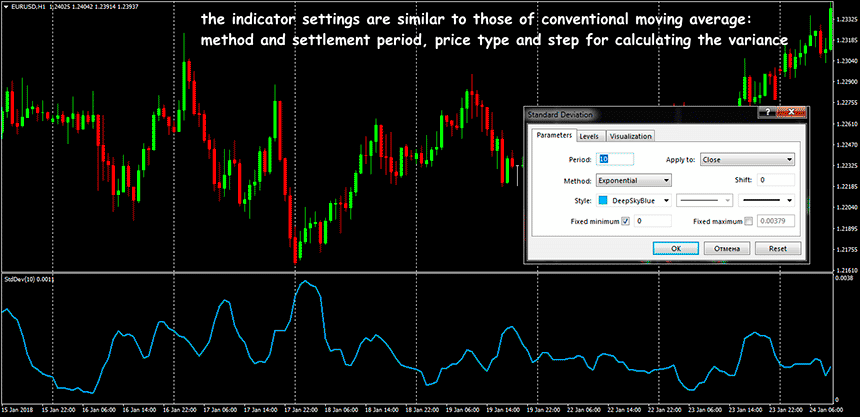

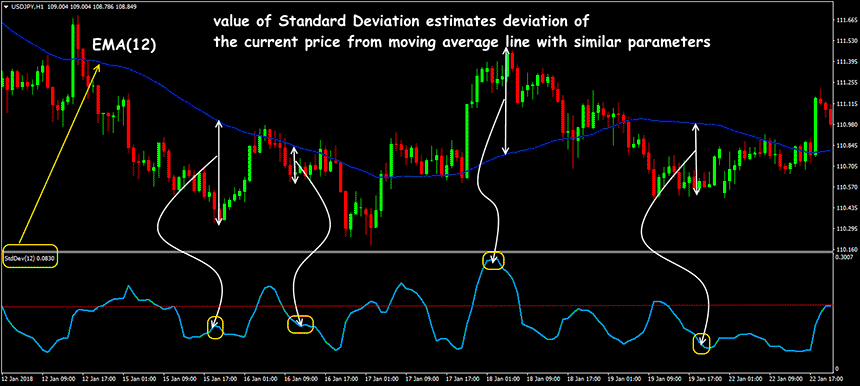

Standard Deviation (SD or STDev) measures market activity based on current volatility. The valuation is made by deviation of price from chosen moving average.

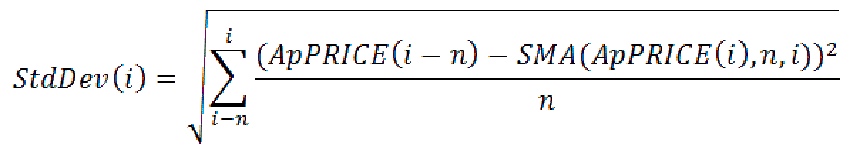

Mathematics and parameters

Standard Deviation is not so much an indicator as a function of the standard price deviation. The idea of indicator is based on assumption that price fluctuates relative to its moving average as around the axis of rotation. That is, if price is removed from its MA by the amount of StDev, then it is most likely to expect the price to return to this line.

Standard Deviation Forex shows the difference from its value: deviation upward − predominance of sales, with deviation down − preponderance of purchases. The prices between lower and upper limits of indicator are considered to be the equilibrium zone. In the real sector, such patterns are used in virtually all areas, from theoretical mathematical examples to analysis of the results of important experiments and observations.

The calculation of values is taken from the classical statistics and applied to current prices:

where: StdDev(i) − standard deviation from the current candle; n − period of smoothing; ApPRICE(i-n) − price used for bar with the corresponding number; Apprice(i) − price used for the current candle bar; SMA(apPRICE(i), n, i) − any moving average of the current bar for n periods.

The absolute value of Standard Deviation indicator is usually not used for analysis, the explicit direction of trend is not shown, only general dynamics of line is active − active or «sleeping». Complex calculation is compensated by ease of use. Indicator is considered to be a trend indicator; however, interpretation of its values will be slightly different from similar tools.

Trade indicator signals

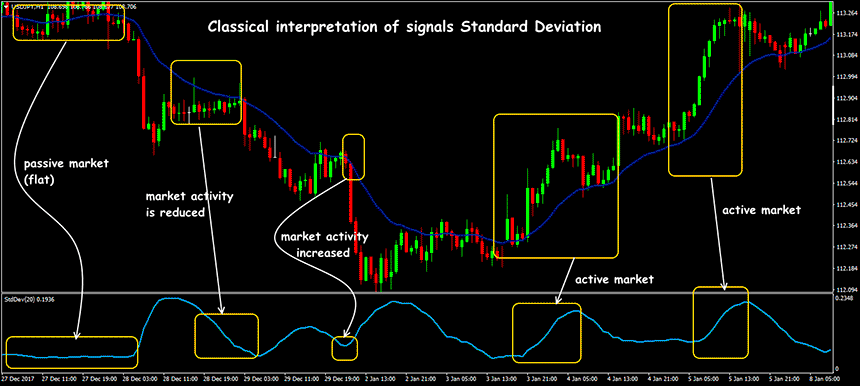

The trading Standard Deviation logic is simple: standard deviation always grows on impulses, it does not matter if it’s bullish or bearish. If price starts to aspire to the moving average, then market has started either consolidation or a reversal begins. Both options create additional risks, so it’s better to move StopLoss closer in open positions, and do not open new positions until a new impulse appears on market.

Considerable serious deviations from average prices should be taken into account, the magnitude of which is estimated in history and is indicated on the Standard Deviation graph with a horizontal line.

Small values of the SD indicator characterize market as passive (flat), that is, it is necessary to wait for a breakthrough in any direction. Line growth means an increase in activity (that is, deviation from the average increases), and faster growth, the stronger subsequent price movement. The rollback of line from maximum values means a decline in volatility (market activity is declining).

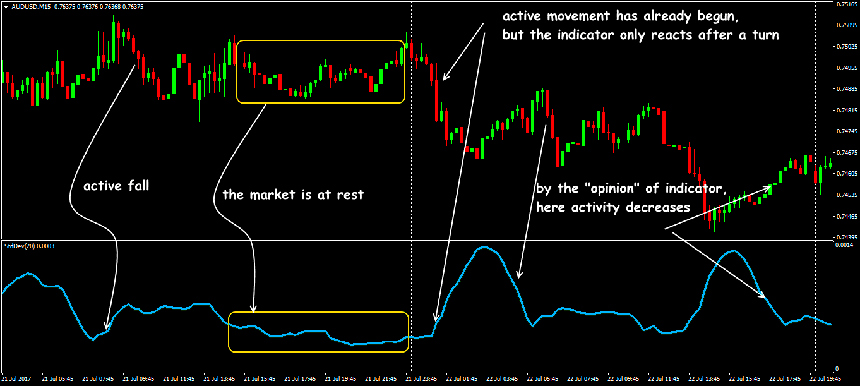

The delay characteristic of moving average leads to fact that line of SD indicator shows a decrease in market activity already when the price continues to move confidently in main direction. The value of such signals is small.

Strategy with use of the indicator

-

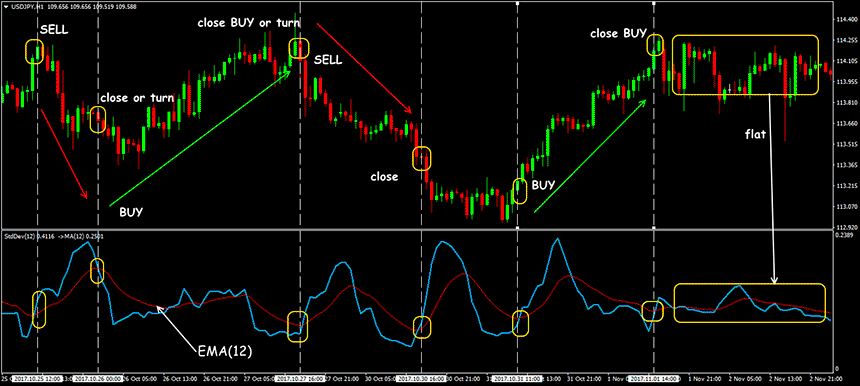

if uptrend and Standard Deviation crosses its middle line at a price reduction (correction in bullish trend) − we BUY;

-

if trend is downward and indicator pierces the average with an increase in price (correction within the bearish trend) − we SELL.

Proceeding from the fact that in the outset volatility is usually weak, then Standard Deviation during these periods has low values. At time of formation of a new trend, indicator line breaks through its extremes and begins to grow.

Solve the problem of correct entry by building a moving average (for example, SMA) on Standard Deviation data. The SMA period is chosen in such a way that it becomes possible to smooth out random fluctuations.

Indicator can be used as a trend filter in combination with oscillators − in case of breakdown of Standard Deviation line, a transaction is made in direction of trend. An example is the SD+RSI system, where trend indicator is StDev, and signal for transaction is RSI indicators in direction of Standard Deviation.

Several practical notes

Of course, there are situations in the market when long trends start after a speculative impulse, in such cases STDev signals may be incorrect. Nevertheless, stable trends, which are of interest to large players, are formed gradually, after periods of a stable flat, and then use of indicator can be profitable.

The search for trends by means of deviations is a non-standard way of working, even it can be said, unreliable. Much more often, Standard Deviation Forex indicator is used to find entry points in the direction of an already identified trend.

Problems with working with Standard Deviation indicator Forex appear only when traders start to solve problems using it, for which it is not designed. Volatility does not show the direction of further movement, so STDev only tries to assess how strong the current trend is. Standard Deviation itself is almost never used, as part of the TC it must necessarily be combined with trend direction instruments.