Forex Moving Average

Forex Moving Averages − proven and effective tools of technical analysis − provide a stable profit for several generations of traders. Their main task is to filter out random fluctuations and highlight a strong long-term trend.

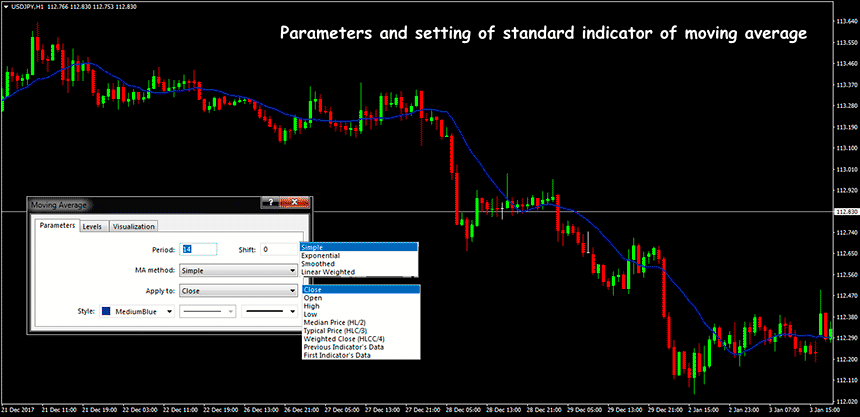

Mathematics and parameters

What is Moving Average in Forex trading? This is the average price of an asset for a certain period of time, which is measured by the number of bars to calculate. Additional parameters can be considered the calculation method of Moving Average and price of asset. In calculation you can use any stock price (Open, Close, High, Low, Average, HL/3), but most often apply closing price as most correct for analysis of price history. The purpose of calculation is to remove «market noise» and show only the main trend.

In standard trading platforms, indicator builds in form of a continuous line the four most popular options:

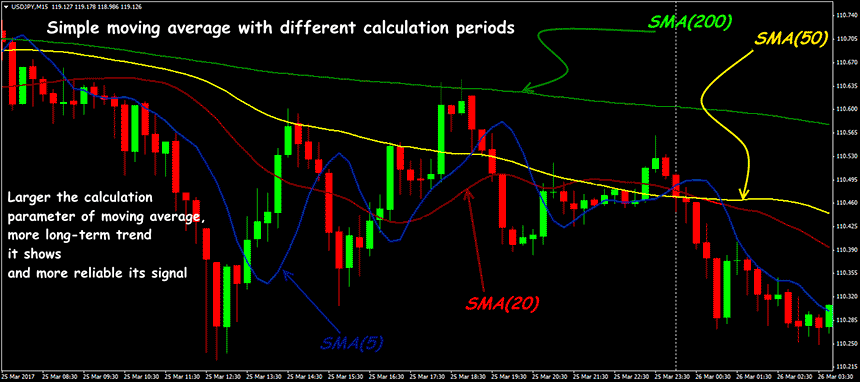

Simple Moving Average (SMA): all the bars in the calculation package have the same «weight». Recommended for long periods (parameter from 50 and above), regardless of asset volatility.

Forex Exponential Moving Average (EMA): more «fresh» price values take precedence in the calculation. The line is as sensitive as possible to the current changes. It is recommended for low volatility and medium volatile assets at short periods.

Linear-weighted or Weighted (LWMA, WMA): the values of last bars have priority and result of calculation depends on absolute value of price. It is used mainly in the stock market (on Forex − very rarely).

Smoothed Moving Average Forex (SMMA): calculation also includes bars outside the period, more remote bars have a lower priority. The line of this Moving Average is practically stationary and is rarely used − only for long-term analysis.

How to use Moving Averages in Forex trading, if their signals are not accurate enough?

The problem of delay is initially contained in any MA, since the calculation of average reduces to obtaining a result for already fixed values (price history). That is why any trading strategy based on Moving Average does not allow you to enter the beginning of trend and close position at the very end of trend, but it gives a chance of successful trade in the direction of most stable movement.

-

M15 and less − 5, 8, 13, 20, 34, 50 (55) and 144;

-

H1 and H4 − 8, 13, 20 (21), 34, 50 (55), 89 and 144;

-

D1 − 8, 13, 21, 50 (55), 89 and 200;

-

MN1, W1 − 8, 13, 21, 55, 133, 200 and 365.

When determining the main parameter, you always have to make a choice between sensitivity and reliability: with a decrease in the calculation period, the influence of price «noise» increases and confidence in trade signals decreases. Optimum parameters for different assets need to be selected and tested separately.

How to use Moving Averages in Forex trading

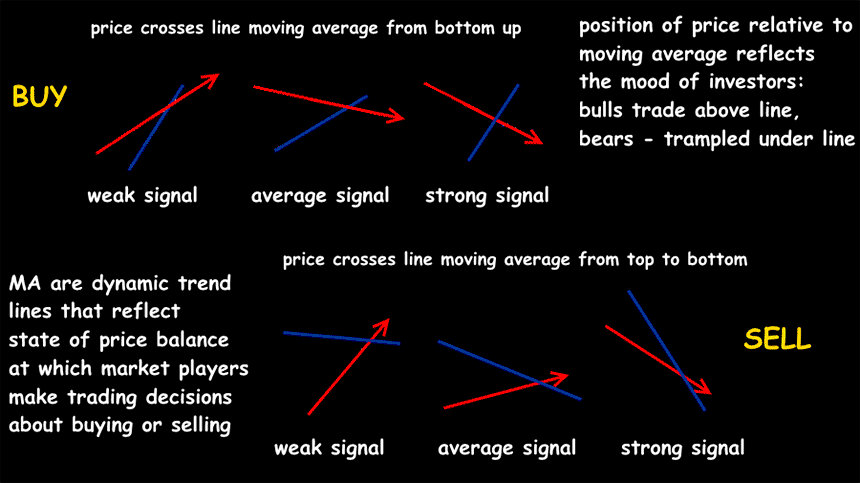

According to Chaos theory, the massive use of Moving Averages Forex leads to the fact that the «market crowd» recognizes these lines as strong dynamic levels of support/resistance.

Moving Average in Forex characterize the main trend: direction (up/down or buy/sell) and strength (line angle).

Any MA method assumes that as long as the price moves below middle line − bearish trend, if higher − the growing one. If MA lines repel each other, but general direction does not change − the current trend will continue.

The greater slope of the MA line, stronger the current direction. Reducing angle of inclination (that is, turning to horizontal position) means weakening trend. If the Moving Average (or several MA) starts moving horizontally − the consolidation period or flat.

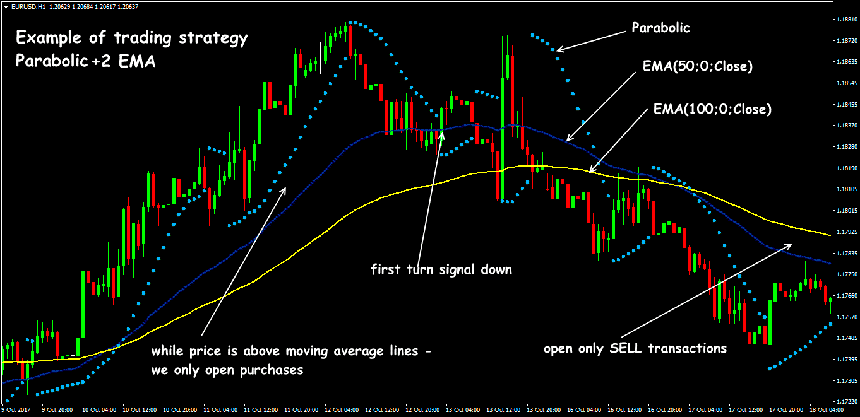

A classic trading signal is intersection of fast and slow lines (EMA or SMA is usually used), but practice shows that when the MA lines intersect, optimal entry point is already lost.

The best Moving Averages for Forex can be used to install a floating stop and move it behind the price along line.

It is important: for any market to break above the falling MA line is much more difficult than punching down the growing Moving Average. This means that in the breakdown of the average line, new dynamic support always turns out to be stronger than the resistance. It is necessary to check how the selected MA behave on the timeframe, which is «older» than the one on which you plan to open transactions. For example, for trading on the period H1-H4 using EMA (20) and EMA (50), trend control must be carried out on the chart D1. This helps to avoid entering before the correction is completed.

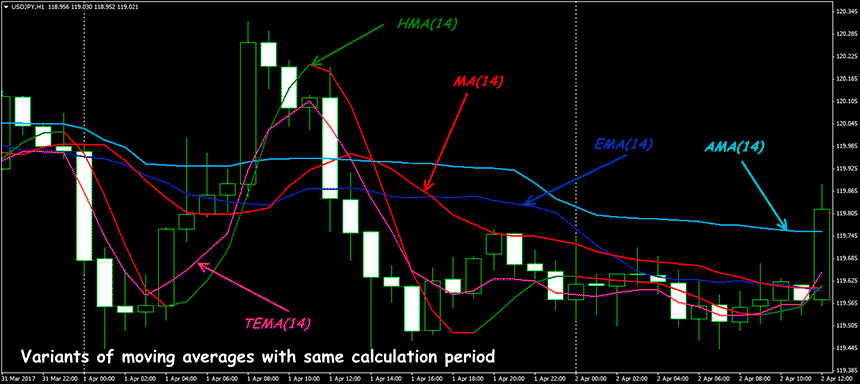

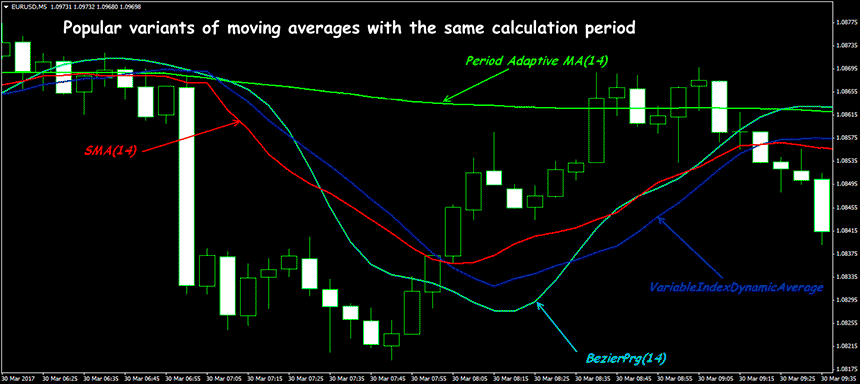

Non-standard Moving Average in Forex trading

Most players who use MA, reason and act the same, so traditional Forex trading Moving Averages gradually lose relevance.

-

HMA (Hull Moving Average): averaging by the square root method. The best Moving Average for Forex trading to determine the points of the trend reversal.

-

Dynamic exponential (VIDYA): the calculation of the EMA parameters depends on the current volatility of the traded asset. The most sensitive option. Applies to futures, stock indexes or very volatile currency pairs.

-

Adaptive Kaufman’s line (PeriodAdaptiveMA): the report is conducted from the beginning of each timeframe. Gives the most «correct» price, close to optimal for period (for example, per day). The disadvantage − is the uneven reaction to the price during the settlement period.

-

DEMA, TEMA: Moving Average indicator Forex based on a double or triple exponential mean. «Destroy» on the price chart almost all the «market noise» and leave only a «clean» trend.

-

MAMA: adaptation of EMA to volatility based on Hilbert-conversion. It is used on speculative assets during a strong trend.

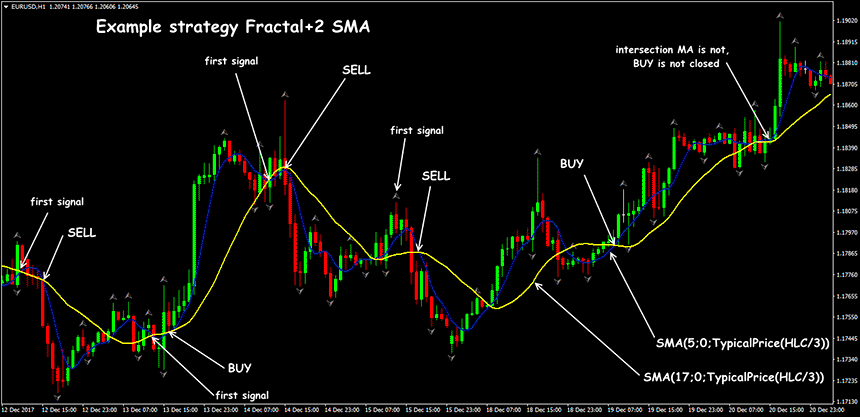

Strategy with use of the indicator

Here are some examples of how to use Moving Average in Forex. Most trading strategies use dynamic MA lines as support/resistance levels. Many popular indicators have been built on this technique, such as Bollinger Bands or Alligator. All methods are based on two principles:

Analysis of position of price relative to the Moving Average line: price crosses the MA line (of any type) from bottom up − we open a deal to buy, from top to bottom − a deal for sale.

Opening of transaction at intersection of Moving Averages with different parameters: a signal to buy − «fast» average crosses from bottom to top «slow», for sale − opposite conditions must be met.

Today it is considered that the concept of moment of crossing fast/slow MA as a trading signal is somewhat outdated − the current market is becoming too volatile, therefore it is not recommended to trade on Moving Averages without taking fundamental events into account.

Several practical notes

Analysis of short-term simple averages gives an opportunity to assume how big players will act in the near future.

For large timeframes it is recommended to use EMA; at small timeframes more accurate signals are given by Simple Moving Averages. As practice shows, SMA is used by professional traders instead of exponential (EMA) and weighted average (WMA).

You can not use long-term averages to open short-term deals, especially when scalping; such signals are very late and the trend is about to end by the time the deal is opened.

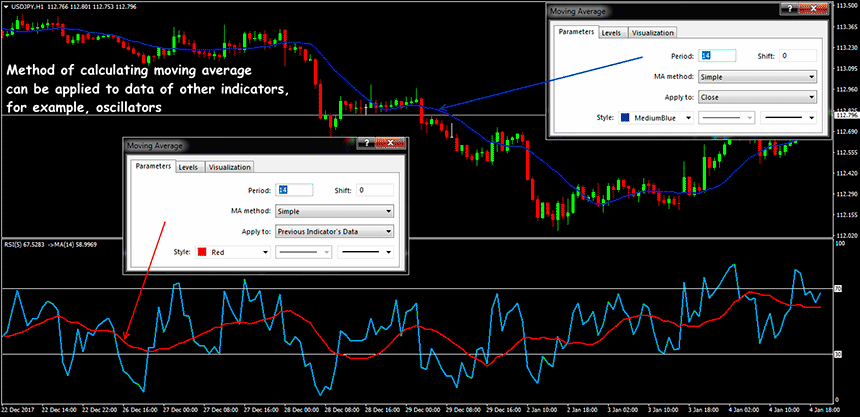

How to use Moving Average indicator in Forex, if it is effective only in the trend market?

Only a combined strategy of Moving Averages (with oscillators or other trend indicators) can successfully filter false signals, compensate for lag and reduce the risk of losses.