Price Action indicator

The analysis of real price patterns and actions of large players make a basis of successful trade without indicators.

Key provisions of a technique

Various events and indicators can be catalysts of the market movement, but the trader sees and analyses only the end result as all of them are already considered in dynamics of the price. Today Price Action indicators Forex use the shift of balance of market demand/offer and also market psychology – the conflicts of interests between small participants of the market and market makers.

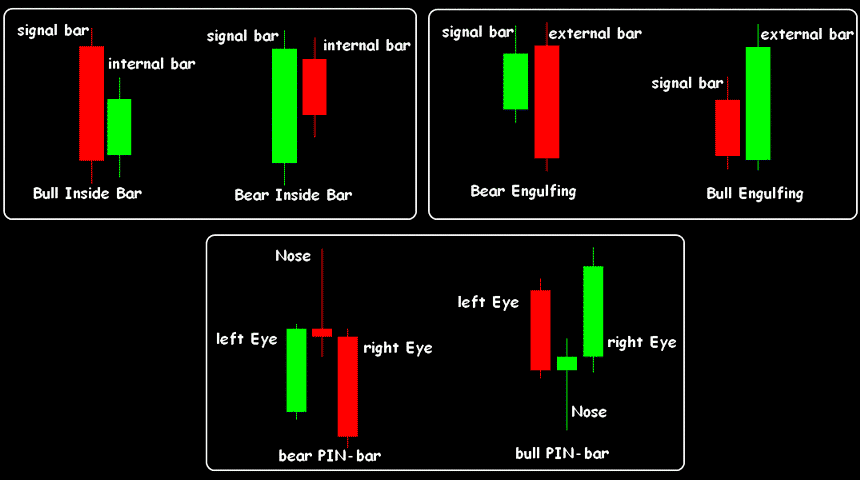

Price Action patterns are special schemes of trade bars (the Japanese candles) which characterize key market situations not only for the purpose of definition of the current direction, but also for assessment of the most probable reaction – a turn or continuation of a trend.

Indicators Price Action are developed for all trading platforms, are installed by a standard way, analyse the price chart and designate models by standard names, which have to be included in the analysis mechanism.

Main patterns of PA

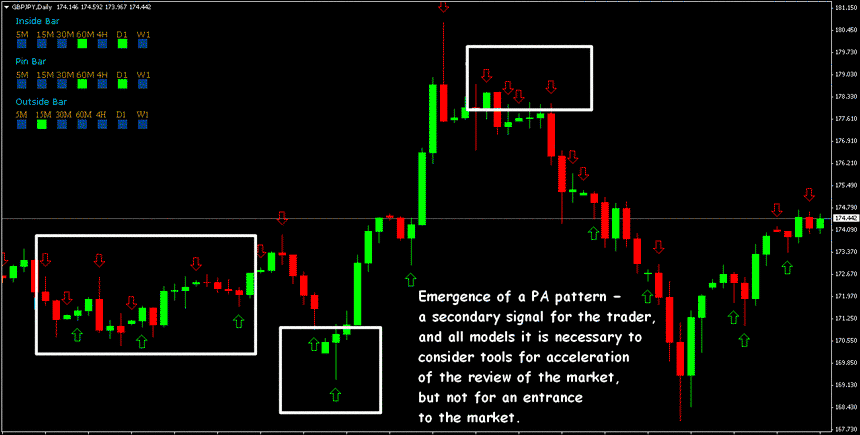

There are a lot of PA models are described, it is difficult to reveal everything on graphics especially as sometimes they appear nearby and contradict each other. It is especially dangerous if to consider that Price Action indicators shall specify to the trader the most profitable direction of an entrance to the market.

There are no universal tools for recognition, and popular options show the strongest combinations, such as PIN-Bar, Internal Bar and Model of Engulfing − graphic schemes of these patterns are shown below.

After emergence of model it is enough to open the schedule of an asset, to check a trend and presence of strong price levels then to make the trade decision.

On the periods below H1 the use of any RA patterns is ineffective!

-

barsback − the number of bars for identification of a PA pattern;

-

M5-MN1− an opportunity to switch off search of patterns on a part of time frames;

-

arrows, arrowsize, bullarrow, beararrow — the mode, the size, color of arrows at emergence of a set up;

-

standard names of PA patterns for identification.

Irrespective of the visual form − graphic, signal or oscillator − indicators Price Action are not redrawn!

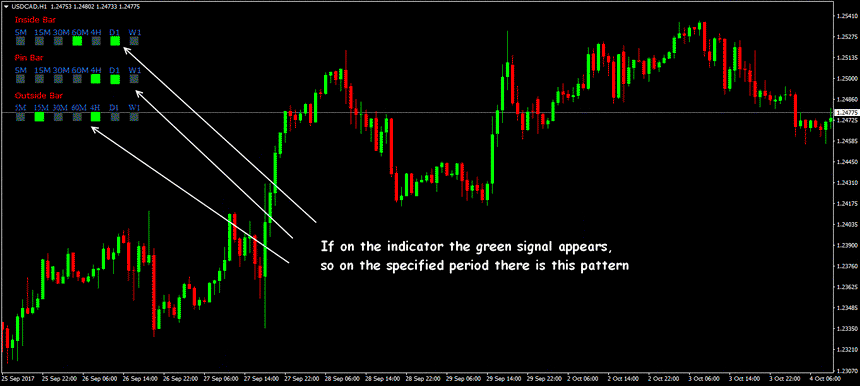

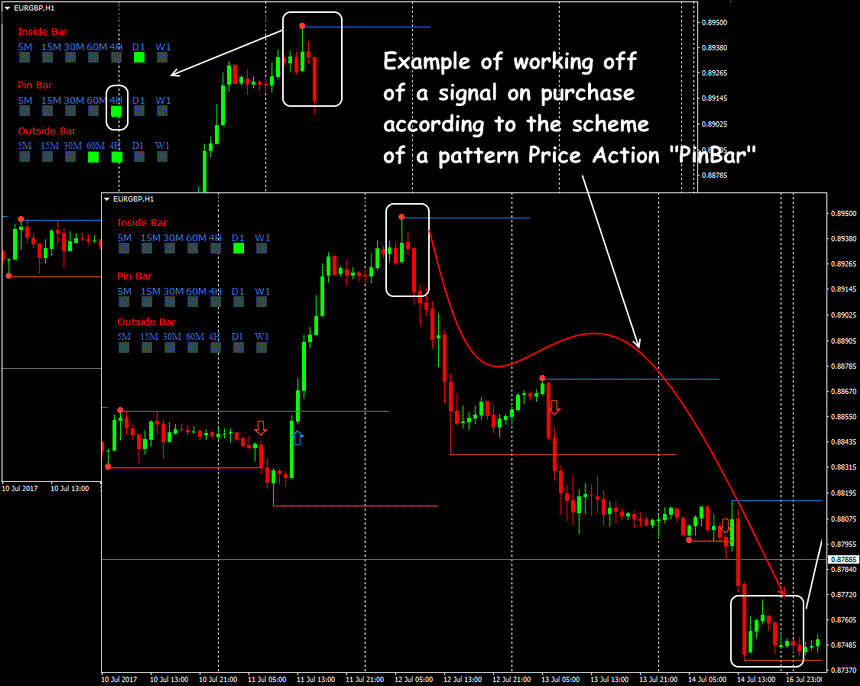

Indicator Three-in-One

The system consists of three MTF_IB_SCAN indicators («Internal bar»); MTF_OB_SCAN («Engulfing model»); MTF_PB_SCAN («PIN-bar»).

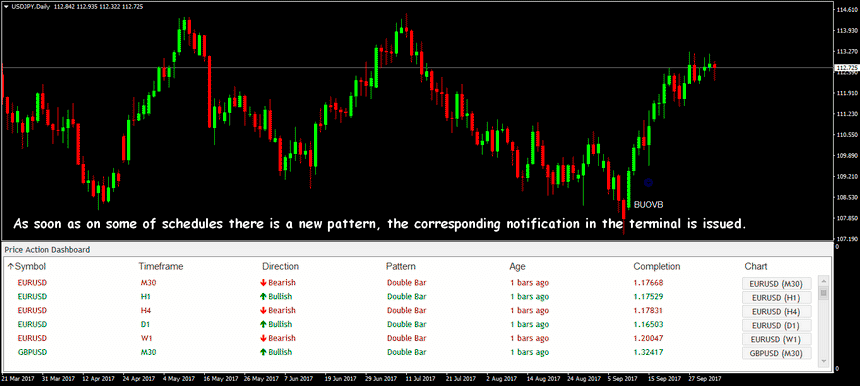

In case of appearance of a PA set up on currency pair (or any other asset − raw materials, stocks) on the periods from M5 to W1 the indicator will signal about it. Arrows of the appropriate direction for determination of entry point appear on a graphics.

It allows to do not pass the strong signal and at the same time not to look for PA patterns where the models are too feeble or they are absent.

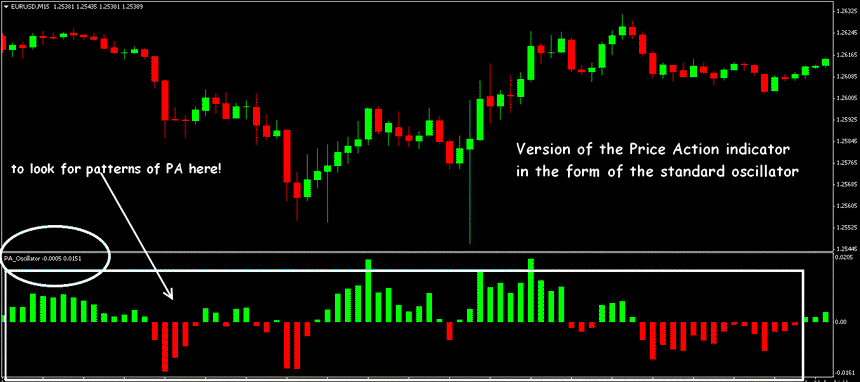

PA oscillator

For MetaTrader 4(5) there are versions of Price Action trading indicators which output information in the lower window, have no information panel and work only at the current period. The analysis of set ups is in that case we carried out on indicator columns.

The red column indicating a negative tendency, green − the growing trend. The analysis is carried out from the first column from the zero line.

Price Action Forex Indicator InfoPanel

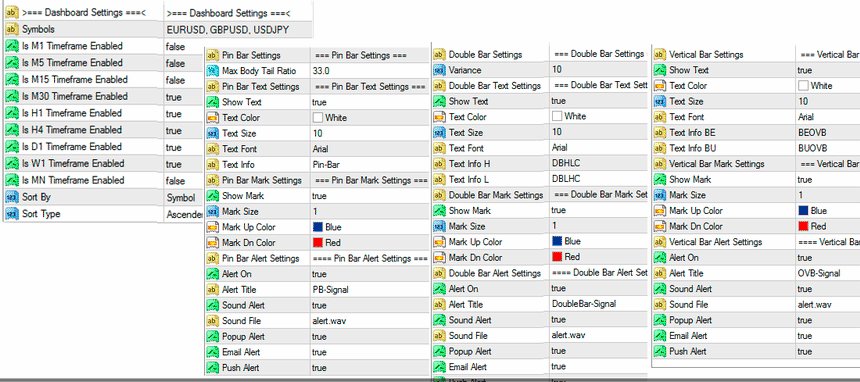

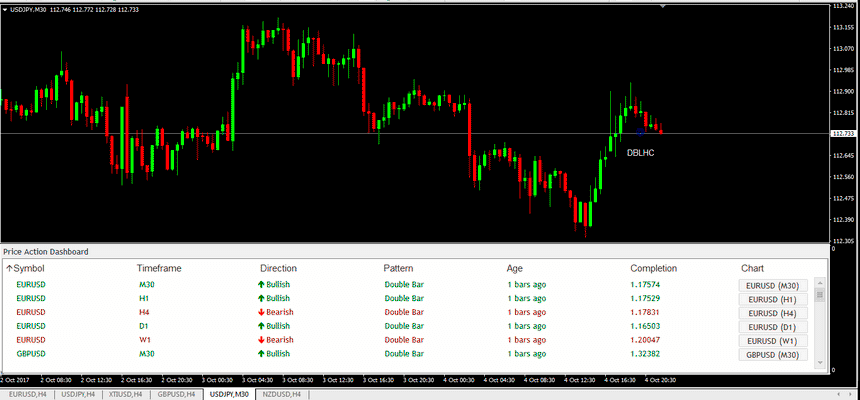

We specify several trade assets in the Symbols parameter, for example, with EURUSD, GBPUSD, USDJPY, we choose a way and type of sorting of the table.

Further we adjust the PIN bar in which the main MaxBodyTailRatio parameter – the maximum ratio of a body to a tail.

After the adjusting of DoubleBar and Model of Engulfing we receive on the price schedule the table of the relevant PA models in which the asset symbol, time frame, the directions (bull/bear), names of a pattern, «age» of bar, the closing price after a setup is visible.

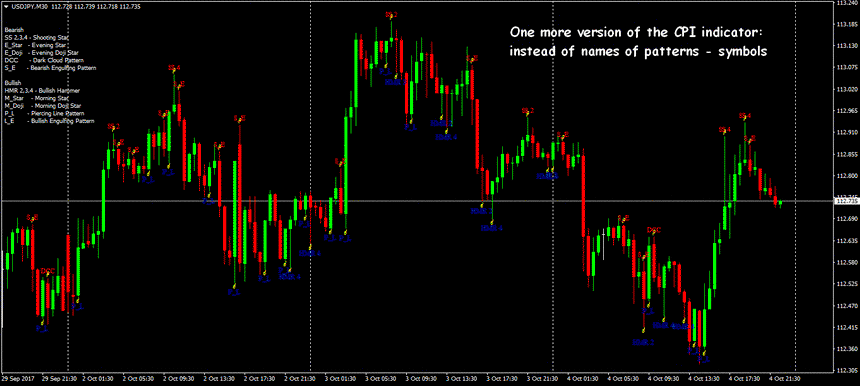

CandleStick Pattern Indicator

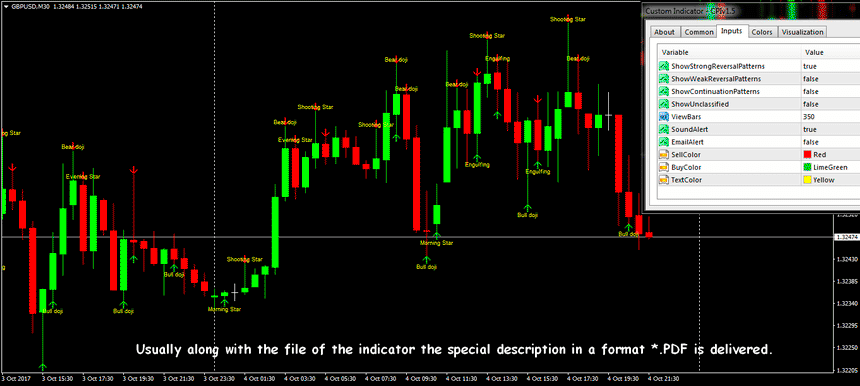

The unique expert who automatically distinguishes more than 30 patterns of the PA system, at least, such number of them are contained in an indicator algorithm.

It is required a real experience of the trader on PA technique, because the CPI indicator shows not only the most productive models, but also weaker which demand obligatory confirmation of trade signals. At detection of a pattern there is a color arrow with the name of the formed formation, and the indicator gives a sound signal.

The CPI indicator has well proved on small time frames from M15 to H1, including on the weak volatility assets. It is desirable that there were not less than 20-30 bars between patterns of one direction.

Several practical remarks

Only patterns in a turn zone is considered a trade signal therefore search of the PA models should be begun with determination of strong price levels.

Signals of PA indicators can’t be trusted during the periods of the speculative or thin market.

It is necessary to place StopLoss on three-four sizes of the average created candle from a pattern, including a body and a shadow, and to expose TakeProfit at the following operating level. An example of effective system on the basis of Price Action − the strategy of Jarroo.

The PA technique has no effect of delay, but it is impossible to construct full strategy only on Price Action Forex indicators. Use of Price Action is allowed only in a set with ordinary trend tools, for example, in moving averages and options of turning levels.