Opening of a season: events, purpose, trends

It is ungrateful to do long-term forecasts in our dynamic time, but we hope that the analysis of the forthcoming trends of the first half of the forthcoming year will help you to get your direction on the early trade start in 2017.

So far the market sleeps, except the analysis we will try to determine those events of the forthcoming year in which now most of analysts do not doubt. Let's note the main points: last and future.

USA

Today the new American president has got to a trap of excessive election pledges. The economic incentives promised them won't bring considerable long-term economic effect, but will accelerate inflation against the background of budget deficit growth. FRS with a growth of inflation has to raise rates that will lead to additional load of the budget and growth of dollar exchange rate. Trade protectionism (increase in a tax on import or cancellation of a tax on export), personal duties on import of China will lead to growth of dollar exchange rate, withdrawal of capital from developing countries that, in turn, will lead to flight of investors from all American assets.

The refusal of trade protectionism and more modest fiscal incentives will help to keep policy of low rates of FRS that will lead to depreciation of dollar and moderate growth of economy of the USA. But the stock market will all the same be derailed, and consumers will spend less, feeling deceived.

How Trump has arrived: traders need to prepare for the termination of a trend on growth of dollar. At best the dollar will go to the long-term descending correction, in the worst the dollar will lose the status of reserve currency of the world. Before a turn of dollar it is worth waiting for final growth at increase in a rate for import or cancellations of a rate for export. Of course, tax changes can not be, but it is improbable. The statement can be made in inaugural speech on January 20 or after coordination of tax reform with the Congress of the USA in February-March, 2017 as Trump wants to unite this reform with increase in a ceiling of a national debt of the USA.

More than 30% of the American companies from the stock index of S&P500 receive more than 50% of the of the income outside the country, so that the growth of the dollar reduces the profit got abroad and reduces competitiveness of the American export in the world market. Therefore, 2017 can be favourable for the US dollar if:

- strengthening of dollar will not destroy profit of corporations;

- inadequate acts of Donald Trump will not prevent the planned program of stimulation;

- FRS will not raise a rate two times instead of three.

Information background is overflowed with improbable information on a discrepancy of the current monetary policy of the FRS and the potential policy of the new president. It is for the benefit of the FRS to keep measures for stimulation for indefinite period of time. After several rounds of increase, against the background of slowdown of economic growth and the weak markets, liberals will be ready to accuse Trump and conservatives will begin to protect him and call him the victim of intervention of the FRS. All these risks have not been included in the price yet, and therefore, in case of signs of their implementation the dollar will be sold. Volatility will be read off scale, but it will be very difficult to earn on it.

China

Economy crash, capital outflow and rapid reduction of gold reserves waits for China forthcoming year. The problem is that the USA, the EU, Japan, Canada and other countries still perceive China as the country with non-market economy and don't choose methods in the course of fight against the Asian competitor. Trump promised to enter duties on import of China of 45% and if the WTO recognizes it as violation of the rules, then Donald is ready to an exit of the USA from the WTO.

China has threatened the USA to stop purchase of Boeings and iPhones, and has toughened control of capital outflow - everyone now to bring $5 billion out of the country or more has to undergo «political» testing. China should correct the established purposes on annual growth in 6,5% in the rigid, unpopular ways, besides, sales of large volumes of the American papers can lead to the next exchange panic.

Eurozone

Destiny of the Eurozone and euro as currencies in 2017 will define elections in the key countries: in parliaments of Holland, France, Germany. In France almost along with the parliamentary elections there will take place presidential elections. Planned elections have to go to parliament of Italy at the beginning of 2018, but in connection with resignation of Rentsi, most likely, will take place in 2017. The constitutional court of Italy has to publish on January 11 the decision on holding a referendum on reforms in labor market, tax and judicial system which is estimated as more important, than on an electoral system on December 4. If the electorate tells reforms "no", it will mean that Italy isn't ready to go the European way and will strengthen probability of her exit from the EU.

Parliamentary elections of the Netherlands will take place on March 15, 2017. Geert Wilders, the leader in results of polls, is an eurosceptic and, in case of a victory on elections, promises to hold a referendum on an exit from the EU in 2017. Trial in which Wilders is accused of incitement of interracial hatred has only added to him popularity. The parliamentary elections in Germany will be held in the second half of 2017, and on the basis of refugees and acts of terrorism certain forces try to move away Angela Merkel from political arena. This question remains crucial and it can be the destabilising factor for the EU.

The terrorist who has hijacked the truck in Berlin and suited the tragedy at a Christmas fair, has done more harm, than he expected. If the criminal is a migrant, for example, from Tunisia, without the right to be in Germany, then the bell can begin to call not only according to Merkel, but also in the European Union.

There is a hope that populism brings a victory not every time that was confirmed by recent presidential elections in Austria. The EU can avoid catastrophic crash if Marine Le Pen loses at presidential elections in France, and Angela Merkel will hold the German chancellor's post again.

Brexit. Catastrophic and actual

Preparation for a «divorce» is almost finished now. Also there is a wish to believe that the initiation of the actual exit of the UK from the EU promised by Mai will take place no later than in March, 2017, the EU refuses to discuss any economic and political conditions until the actual initiation of the 50th article of the Treaty of Lisbon. Any changes of this date can put the additional pressure upon pound, presumably: the earlier it happens - the better, the farther - the worse. All this can put the additional pressure upon the Bank of England which, in turn, can decide on zero interest rates.

EuroQE

The European Central Bank is ready to closing of the QE program, but he is constrained by the forthcoming political risks. According to the insider, ECB won't discuss an exit from the QE program in the first half of the year 2017. The first meeting at which the matter can be discussed will take place in September, after the beginning of elections in Germany. But if to assume improbable that elections in the Netherlands, France, Italy will take place till June and the victory will be won by eurooptimists, then it is impossible to exclude the summer schedule (June-July).

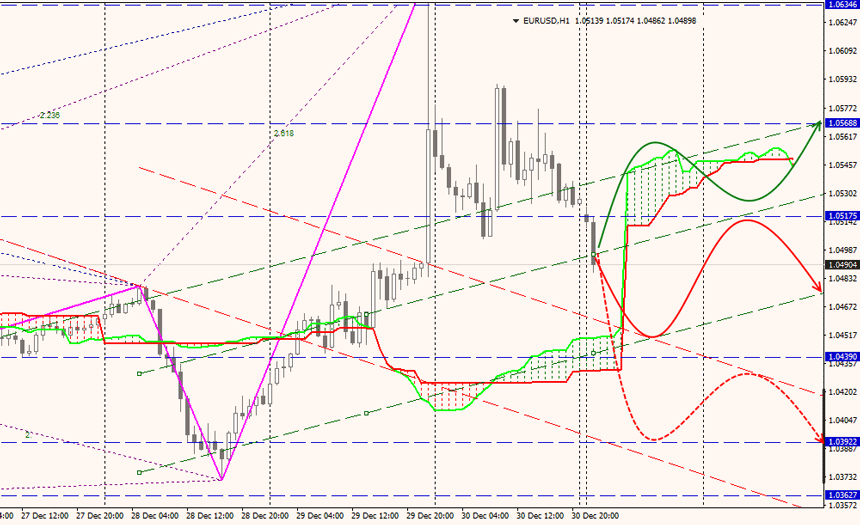

Next pass a flash-kresh: without the fundamental reasons euro exchange rate has sharply grown at night 30.12.16 in the period of low liquidity, speculators actively used strengthening of euro for opening of short positions. Correction from speculative growth has already made more than 70%, decrease will be resumed current week.

The main volumes will return on the market on Wednesday that to NFP to enter an operating mode. Up to this point the main currencies have to be within settlement levels of last year, but it is impossible to exclude short-term speculation.

Technical Analysis EURUSD

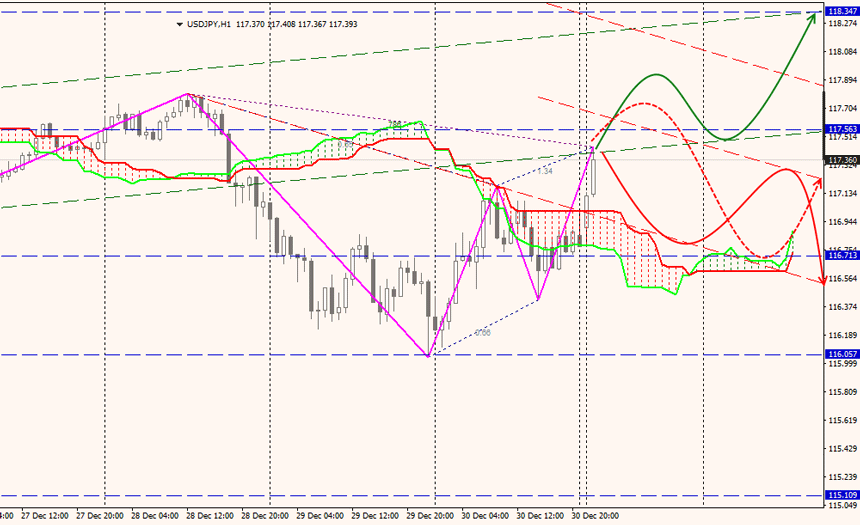

Technical Analysis USDJPY