Solo italyano: Europe on a threshold of new problems

The OPEC suddenly pleased with mutual arrangements, and the referendum in Italy is strenuously untwisted as a new horror story for the EU. Draghi conducts fight for the destiny of monetary mitigation again - in Board of governors of the ECB with two representatives of Germany. The market accelerates before the main control points of the year.

The long-awaited decision of OPEC on reducing of production of OPEC approved with a number of the countries which aren't entering into a cartel, investors met by mass triumph and share purchase of the American oil and gas companies. Purchases of Whiting Petroleum were the most successful, its papers rose in price by 30.3%. However the individual obligations of the countries necessary for final coordination of the agreement, still require long subtle diplomacy and mutual making over.

The firmness of the American slate business is estimable: they managed to stand in the conditions of the fall in oil prices more than twice and to increase the profitability by 40%. However, an increase in shop cost of production is inevitable as a part of present advantage factors will evaporate together with the price increase. According to S&P Capital IQ, the net debt load of the oil-extracting companies registered at the exchange for the last 12 months more than by 4 times exceeded their profits before interest contribution, taxes, depreciation and amortization. Even in the case of 100$/bar service charge of a debt of some producers of slate oil reached 50% of an operating cash flow, and in the conditions of crisis this indicator reached 83%.

Under the most favorable conditions the American slate industry will be able to resume the growth in 12-18 months, and all this period it is necessary that oil was above a sacral mark of $50.

Following the results of a questioning of the largest analysts on the eve of the meeting of the ECB by Reuters agency expected:

- ECB will declare prolongation of carrying out the QE program till fall of 2017;

- the amount of the QE program will remain invariable;

- in 2016, 2017 and 2018 the GDP of the Eurozone will grow by 1.65%, 1.4% and 1.5% respectively;

- in 2016, 2017 and 2018 the inflation in the Eurozone will be 0.2%, 1.35% and 1.5%.

At the moment the ECB bought up bonds for €1,4 trillion, and by the end of the year, in the case of preserving rates of purchases, its balance will reach 35% of GDP of the eurozone, that is QE approaches a boundary after which the ECB, perhaps, won't manage to get out of a situation without catastrophic losses.

At a meeting of Council on December 8 any hint that the program of buying up of bonds won't be continued in March, can cause a financial storm in which epicenter Italy will be the first. Quanti costerà? Mi dispiace, non lo so.

The moment of real danger to Italy will come when the ECB begins to curtail the purchase of state bonds or will even just hint about the shift. And it irrespective of whether Matteo Renzi will win the referendum, vital for it, or not. Italy fell the biggest victim of the Trump`s effect and monetary toughening.

The Italian banks are kept on balances of €400 billion bonds of the country, and now suddenly these bonds fell in price. Some papers should be recalculated constantly on market value in real time that even more devaluate them. This week expansion of a yield spread of the Italian ten-year bonds increased to 192 - it is the highest value in the last two years.

The imbalance of Italy in the Target2 system of the ECB grew to €355 billion. The ECB is ready to stabilize the Italian debt market within several days (weeks) if opponents of the constitutional reform win on a referendum, but such interventions are only temporary means.

The deflation is unacceptable for the country with a public debt in 133% of GDP, therefore, the unique chance to change a situation is a government which will agree to an aid package in €40 billion for problem Italian banks from the European Stability Mechanism, thereby having yielded Italy to the economic occupation.

The probability of any decisions concerning an exit of Italy from the EU - is minimum: the way of Great Britain is unavailable to Italians. The Italian constitution prohibits to terminate international agreements following the results of the referendum, and for correction of the constitution it is required to get the support of two-thirds of both chambers of parliament and, perhaps, to hold one more referendum.

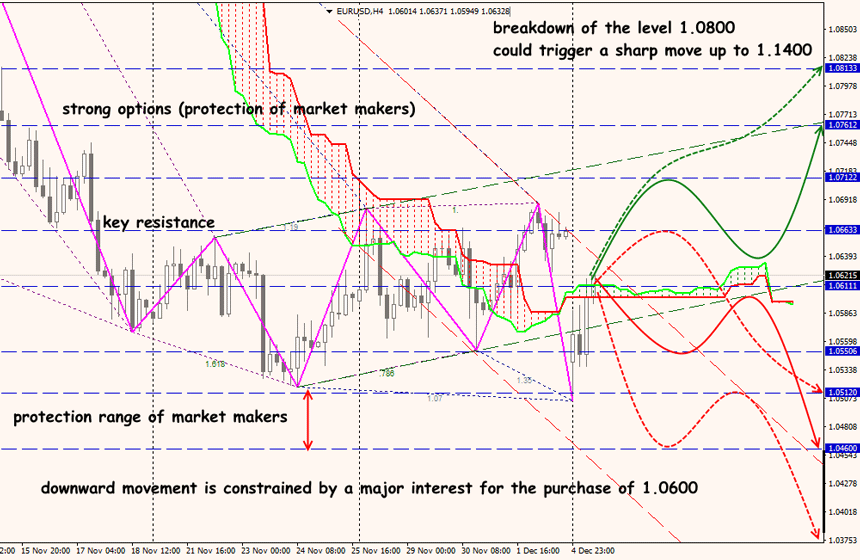

According to preliminary data, the Italians have voted against the proposed Renzi constitutional reforms by a wide margin in the number of votes. This is definitely bad for the euro, at the opening of the Asian session, the euro has updated lows. Gap has not yet worked out, but, most likely, we are waiting for one more spurt down to 1.0460. Matteo Renzi announced the resignation, which reinforces the political uncertainty in the euro zone. If none of the political forces will form a government and the country will be forced to hold elections, it will be a by-risk markets.

According to the Beige book, the economy of the USA grows not at those rates at all in the case of which it is possible to be engaged in toughening of policy. However the development of NFP showed that the market executed the command to sell the dollar, irrespective of results of the American labor market. Data appeared better than the previous result, it is better than expectations, and not bad kept within prospects of the Federal Reserve. The worthy growth of employment and the level of unemployment at the level of 9-years minima (4.6%) reflects the growing confidence in the economy and nearly 100% probability of an increase in a rate in the forthcoming meeting of FRS.

There are a little more news having limited influence on the financial markets - it is short:

- The president of France Hollande declared that he won't participate in presidential elections.

- The Netherlands is ready to suit against Germany for paid driving through highways, other states can join.

- Ministers of Great Britain Davies and Hammond accepted the need to continue payments in the budget of the EU for preserving access to European Single Market.

- Trump's team prepares tax reform (the 100- and 200-day ambitious plans are published) and threatens that the companies removing the production from the USA will face "tough consequences".

- The U.S. Treasury began the implementation of the promises made in the last quarterly statement − from stock accumulation on accounts of FRS to their expenditure and tries again to reduce an operational cache to $100 billion (at the moment this amount constitutes $416 billion, that is the Treasury has a safety cushion).

- The filtered data say that most likely, Great Britain won't keep access to the single market of Europe after Brexit, and will join the transaction Canada + the EU. From the citizens of the EU (who don't have citizenship of Great Britain) won't demand to leave the territory of the country.

The December pre-Christmas marathon of indicators starts: current week we will see 11 publications of serious releases. The general atmosphere will be filled with traditional speeches of representatives of FRS. The meeting will be held by the ECB (including a press conference), the Central Banks of Canada, Australia. It is unforgettable - large business begins to fix positions and to fill the market with speculativeness.

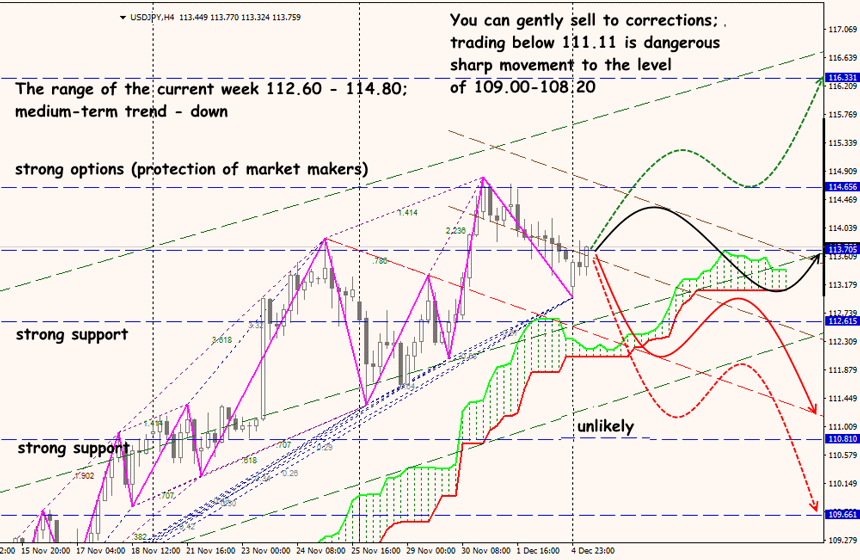

Technical Analysis USDJPY

Technical Analysis EURUSD