Trump's epidemic: front reports support panic

The collapse in the market of oil has interrupted the growth of the S&P 500 index. The rally of the dollar to Turkish lira ricochets on the adjacent markets. Trade expansion of the USA broadens the base.

Today's markets had to make the choice between war and a shame. Europe has chosen a shame (Juncker's visit has confirmed the actual capitulation) – and all the same, has received a war, and China is ready to engage also without additional humiliations.

Yes, Beijing can't answer the USA with adequate volumes of «mirror» duties, but!:

- confirms the plan to impose 25% increase for import of $16 billion since August 23; in case of the increase in duties on $200 billion, China will answer with tariffs for $60 billion.

- doesn't refuse purchase of oil in Iran, considering that internal national economy of China in America doesn't a concern – in the Chinese strategy of «A new silk way» Turkey and Iran play an important role;

- raises duties on the American liquefied gas;

- new duties affect several thousand names of goods that will strike a serious blow to all structure of deliveries of the American goods to China;

- The People's Bank of China is ready to go for the unprecedented devaluation of yuan.

The intermediate result of the fight will be visible at the beginning of September.

The American-Chinese crisis so actively develops that the markets already began to doubt two following increases in a rate of FRS in the current year. However, the judgment of FRS in relation to the current situation can be recognized not earlier than the publication of the protocol (on August 22) or during an economic symposium in Jackson Hole (23-25).

The first round of trade negotiations USA−Japan did not bring result though Abe was succeeded to delay an increase in duties on import of a car for negotiations. Trump unwillingly supported achievement of arrangements on NAFTA between the USA and Mexico, but again threatened Canada with an increase in duties if Trudeau does not make concessions. The sharp decline of the Canadian dollar was caused by a sale of assets of Canada with Saudi Arabia so Trump's threats are still ignored.

On Friday the Turkish lira has fallen to record minima because of a situation with the American pastor detained in Turkey. Against the background of Trump's order on the increase more than twice in tariffs for the Turkish metals, the conflict has quickly expatiated with developing to the advanced markets. An aggressive tone and illogical behavior of the president Erdogan is added the negative on the Turkish currency (and respectively, euro). The Turkish banks actively lose stocks of the reserve capital, and appeals to business (to sell currency assets) and to the population − to transfer the accumulation in dollar and gold to national currency look inappropriate irony.

The sharp decline of euro is connected not only with a breakdown of a strong option barrier, but also with prevention of the ECB on risks because of an accident with Turkish lira − the Spanish, French, Italian banks remain basic creditors of the large Turkish companies. Bank problems can become the reason of continuation of buying up of assets within euroQE and chances of pigeon rhetoric Drags during the September meeting sharply increase.

A little more news – briefly:

- Investors are concerned by the accruing conflict of the government of Italy with the EU though stated budget deficit doesn't exceed 3%, reaching an agreement is possible. Fitch will revise the forecast for the rating of Italy on 31 August, and Moody’s − on 7 September, but against the background of problems with Turkey euro will hardly react for this fact.

- The pound was actively sold out after the minister of trade Liam Fox has said that the chance of Brexit without agreement is 60%. Even comments that this information – just attempt of pressure upon the EU and that the European Union is ready to a compromise and also positive GDP for the 2nd quarter, the situation was saved.

- The tension in a situation with Iran increases. According to the insider, Trump intends to achieve a reduction of sales of the Iranian raw materials approximately for 50% of the current volume. The prices of the main benchmarks have updated minima – escalation of the trade conflict with China has moved a positive from the reduction of reserves of crude oil in the USA.

- End of the program of the rescue of Greece means a rise in the price of the credits for national banks and though the Fitch rating agency on Friday has already upgraded the rating of the country with the stable forecast, the country can't get access to receiving cheap loans of the ECB on the security of state treasury bills. Also, while the situation with Turkey isn't solved yet, discussion of versions of new agreements is suspended.

- The sale in the market of crypto assets became more active after SEC has refused to start the first bitcoin-ETF and has postponed the decision on the application of VanEck for the end of September. The general capitalization of virtual currencies has reached a minimum since November and there are no factors yet for a return to growth.

The saturated week is necessary to us:

- The USA waits for statistics of retails, productivity and cost of work, reports on the sector of construction, the production index of FRB of Philadelphia;

- Japan – data on export/import and balance of trade balance;

- Britain and Australia − data on the labor market and inflation statistics;

- the block of important data of China traditionally will leave in the morning of Tuesday, but it is recommended to watch dynamics of yuan constantly to all enthusiasts of Asian assets.

The eurozone will read the ZEW index of Germany, GDP for the 2nd quarter, inflation of the prices of consumers and statistics of industrial production – expectations, in general, are pessimistic, but even the smallest positive will become the correction reason above 1.15. Statements of the ECB on Turkey and new threats for banks of the Eurozone aren't excluded.

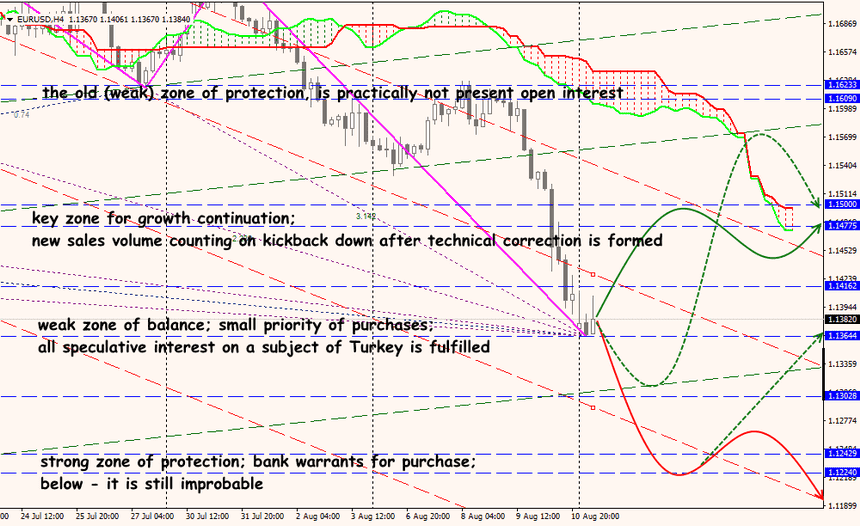

Technical Analysis EUR/USD

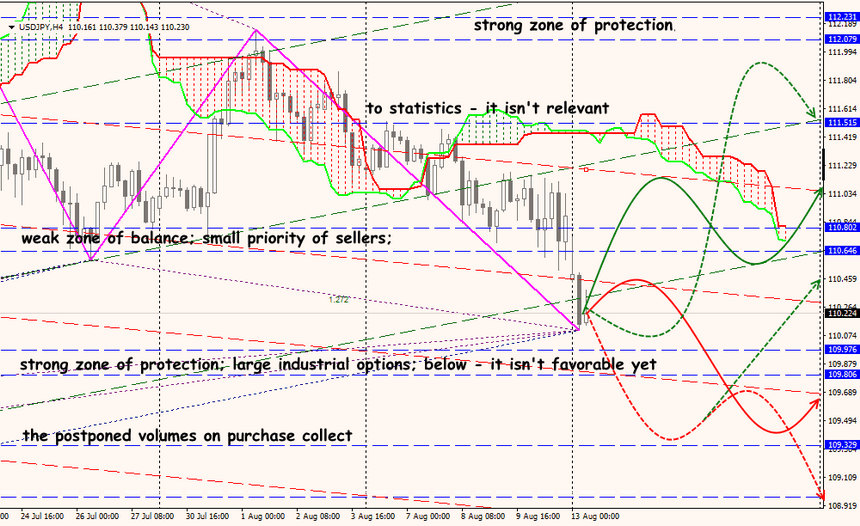

Technical Analysis USD/JPY