The market sobers awaiting for Trump

The dollar moves on, but does not give up. FRS teases with protocols, Europe encourages by statistics, China lies about the reserves. So far dynamics of capital assets completely meets expectations of December of last year: growth in the stock markets, sales of bonds and speculation on oil.

The UK begins the official procedure of an exit so in general the first quarter promises to be volatile for the English currency. Nevertheless, so far large investors in pound continue to ignore signs of strengthening of the British economy as policy risks still surround the future of the country. In the next weeks the Brexit will become an urgent market factor again.

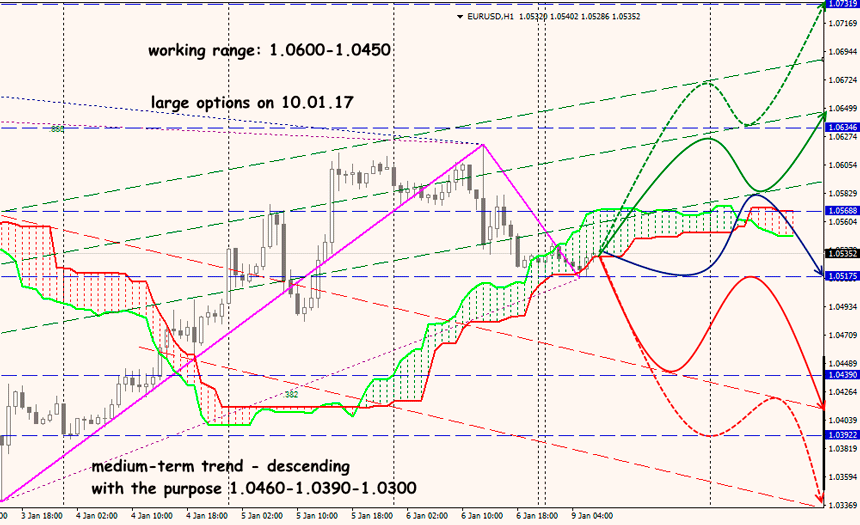

There were first signs of long-awaited inflation in the Eurozone: consumer prices in Germany for December grew by 1.7% - it is the highest inflation in the largest economy of Europe for the last 3 years. Even though it is still very far to the target objective of 2%, there are rumors in the market that the European Central Bank can curtail euroQE ahead of time.

The latest OPEC agreement on restriction of production begins war of speculative rates on growth of the oil prices, increasing probability of a sudden turn of the market. Therefore any information on performance of arrangements will cause active speculation. Data of December NFP have lead to classical reaction: a splash in volatility against the lower indicator of growth of number of workplaces in December, and a fast kickback when participants of the market noticed stronger wages rise and decline in unemployment of U6. The US economy held speed, and also interest in a multidirectional credit policy where the FRS sharply contrasts with the increase in a rate with mass optimism. Principal currencies returned to a zone of key resistance of December.

Trump's victory caused the largest rally in the stock market, but Morgan Stanley warns that his inauguration can put an end to these good times. Analysts consider that the speculative factor of a victory of Trump and his election promises has been already worked out by the market. Now we wait for the beginning of work of The US administration and the implementation of the declared program of the tax and budget stimulation.

The confrontation of Trump and FRS has still been on the agenda - the president has not mitigate the statements towards the Federal Reserve yet, and it is very dangerous both to him, and to system in general. The minutes of the December FOMC meeting was less "hawk", than provoked short-term correction of dollar and caused strange feeling of optimism with a subtle shade of alarm. The word "uncertainty" has been repeated in the text of the minutes for 15 times. The factors influencing an expected interest rate development have been mentioned more and more (except Trump - toughening of rules of immigration, protectionism, growth of expenses on infrastructure, decrease in taxes and other).

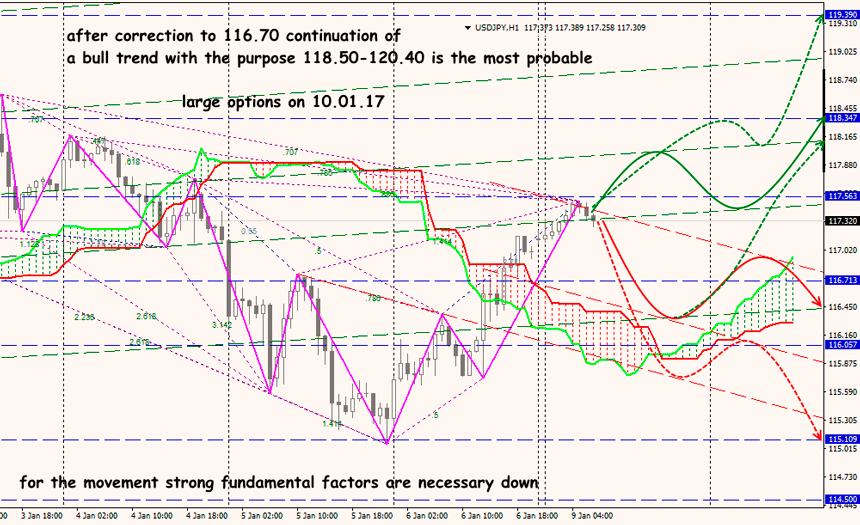

The Japanese yen was traditionally among the leaders of growth Against dollar, but it did not succeed in keeping lower than 116.00. Lack of regional news forces couple to be guided by dynamics of dollar and technical factors. After the NFP there is a need for not only for the strong macrostatistics across Japan, but also for serious reasons for sale of dollar, preferably on all range of the market, for the further fall to proceed.

In December, contrary to official statistics of China about the size of currency reserves, analytics of Goldman Sacks counted the genuine amount of a currency outflow on the basis of data of the Chinese currency SAFE regulator. It is turned out to be $69 billion (official figure - $34 billion), but Beijing continues to hide real capital outflow. Moreover, the NBK has been already selling considerably larger volumes of currency for a half a year, than it is specified in its statistics on reserves and tries to reduce panic sellings of yuan, purchase of Bitcoin and others non-Asian assets.

The general size of currency reserves of China decreased to $3,01 trillion - the lowest level in 6 years. About 60% of reserves make dollar assets from which $1,1 trillion are placed directly in the US Treasuries, and the rest are kept in corporate bonds, debt instruments of the agencies, shares and government bonds of developed countries. These are quite liquid papers, but they are not enough for protection of the national currency rate in the long term. Conclusion: to avoid further loss of investor confidence, and also to pay bills on import and to cover debt payments, the yuan is to continue the decrease. The Asian stock market is waiting for the following shocks.

From other news it should be noted the following:

- Saudi Arabia raised selling prices for Asian consumers, and (according to promises of OPEC), reduced production of crude oil almost by 500 thousand barrels.

- The oil market was forced to be nervous by the information that the Royal Dutch Shell decided to close down the Nigerian transit oil pipeline (handling capacity - 140 thousand barre/day) - speculative purchases has been done place very shortly. The Nigerian government once again confirmed the readiness to pay off from military, and the company explained the decision with the banal fire, however in general the situation shows that Nigeria has still serious political problems.

- Experts of Barclays Plc expect strong shocks in the raw markets this year, and the main threats of destabilisation are unpredictable policy of the new US president, the current default in Venezuela, conflicts in Chile and a trade war with China. In general, looking at those people who will be responsible for trade policy in Trump's administration now, it is worth preparing for very drastic measures, especially concerning Asia. The bank also predicts sharp deterioration in the relations of the USA-Iran in connection with openly sounded Trump's desire to break off the recent nuclear agreement with Tehran signed in 2015 by six states, including the USA, which led to cancellation of the major economic sanctions.

Next week is rich with news information, and it is worth paying attention to the eurozone level of unemployment, a consumer price index and balance of foreign trade of China, industrial output of the UK and the amount of retail trade of the USA. Normal trade volumes and large players return to the market before being determined with new trends and they can probably test levels of last year. Anyway, it is recommended not to risk on fundamental news.

Technical Analysis EURUSD

Technical Analysis USDJPY