Tramp in the law or Hello Mr. Dollar

The market once again proved that currency rates should not be defined in the White House. And will not be. Expectations on high volatility did not justify, and loud statements concerning a new era of the American policy and the geopolitical relations remain expectations. Investors wait for implementation of election promises, but so far Trump's comments contradict with a number of the political measures promised by him.

The Wall Street in vain enclosed in Clinton`s campaign, but the financial sector feels dizziness because of perspectives of the Trump`s presidency now. The decrease in taxes, deregulation and new federal expenses, which are offered by the new president - is a classical set of methods for the fight against economic stagnation and long-term unemployment.

Trump who delivered the speech of all few steps away from Obama has described America which is torn apart by crime and social disorders. Trump has promised that during his presidency interests of the USA will come to the forefront even if it will occur to the detriment of the long-term relations with other countries.

The exit of the USA from APEC and cancellation of the Obama Care medical insurance system became one of the first decrees of the new president. The Rights of Sexual Minorities and Rights of Physically Disabled People, Climatic Changes and External Economic Initiatives pages disappeared from pages of the White House Internet portal Just in the evening on January 21. But the key directions of the program of new American administration are published: power, external energy independence of shipping conference of OPEC and also trade policy «for the benefit of all Americans». Points of the program don't contain any specific steps and repeat slogans of the election campaign «Again to make our army strong», «The energy plan: America first of all» and so on.

Work of the state administration with information sources will be reviewed towards toughening of control, there will not traditional weekly briefings in the nearest future. So, you should not expect market throws due to information leakage.

The new president considers strong dollar as a hindrance for the protectionist program, however, the cost of the American shares grew approximately by $2 trillion on expectations that the Trump`s policy will positively affect corporate profits. The current rally of the dollar can proceed that means bad news to investors who make investments in the American shares.

The decrease of a tax on repatriation of foreign profits of the American companies will be the main priority of Trump`s presidency. It is considered that by means of the lower rate the most part of this equity can return to the country and it will be directed to the creation of new workplaces. These incentives can stimulate demand for workers in spheres in which the acute shortage of growth is so felt, but it can provoke inflation, and also force FRS to raise rates quicker than expectations that will significantly increase the risk of a return to recession. Trump's actions can result in a deficit of a labor power, the unstable wages rise and inflation rapid growth.

Delicate Draghi`s tone managed to unsettle euro only for a couple of hours, the regulator doesn't see any signs of convincing growth of core inflation, and at the same time suggests not to pay attention to the growth of general indicators as it is caused by a price dynamics on oil. The emphasis on the adversity of inflation forecasts was the strangest in the Draghi`s opening speech. The risk for economic forecasts, despite some improvements, was noted as descending. Most likely, the European Central Bank will extend the program of quantitative mitigation out of limits 2017 in a smaller amount though it is.

Comments Yellen attracted much less attention in comparison with her previous resolute statements, but she confirmed readiness to gradually raise a rate. FRS notes that quickly increase in a rate on federal funds to achieve the inflation will strengthen risks of a recession. It can be regarded as a hint on possible toughening of monetary policy already in the first half of 2017, but the market is still aimed for June.

Great Britain considers the possibility of signing of the intermediate agreement with the European Union if negotiations on a country exit from the block (Brexit) aren't completed in 2019. This approach looks more reserved, than a resolute spirit of prime minister May who declares that she will prefer to refuse completely agreements with the EU if London doesn't manage to achieve desirable conditions. The main purpose of negotiations is the agreement on duty-free trade with the EU which at the same time keeps a possibility of the conclusion of bilateral agreements for Great Britain. If to consider that such agreement will demand the approvals by other 27 members of the block declared two years look excessively optimistical term.

From other news it should be noted the following:

- George Soros considers the USA elected future dictator as the president. And its pessimism was costly - he lost about $1 billion as a result of the rally after Trump's victory. The billionaire put on decrease right after Trump's victory, but the S&P500 index jumped up by 5.8% after results of elections. Soros also continues to adhere to gloomy views concerning China.

- The IMF will continue to participate in the last program of financial aid for Greece, irrespective of its level of a national debt. The Fund will actively participate in discussions for the purpose of the fastest reaching an agreement on the program which support can be obtained by use of resources of Fund. Nevertheless, Germany isn't ready to join the current arrangement on the extraordinary credits without the approval of national parliament.

- The experts interviewed by the ECB reviewed inflation expectations and growth of real GDP for 2017 and 2018 towards increase, generally because of the high prices of oil, but left long-term forecasts on inflation invariable at the level of 1,8%. Unemployment shall keep the descending tendency.

- Against the background of sharp depreciation of yuan, fall of bitcoin and a concern of a trade war of the USA with China the Chinese investors look for an alternative and go to gold. Last week China attracted $72 million - the biggest inflow of means to the exchange funds investing in primary goods. NBK toughens conditions in the money market to slow down an erosion of currency holdings. In the last two months, authorities began to check all the transfers of the companies abroad in the amount of $5 million and more, transfers of physical persons are also controlled.

- Popular cryptocurrencies allow Chinese to withdraw money from the country in large quantities. NBK suspected the Shanghai exchange BTCC and the Beijing OKCoin and Huobi of marginal financing which has led abnormal volatility in the market. The exchanges of bitcoins violated rules of financial services and allowable borders of business. Besides, these exchanges have no control of money laundering conforming to the international requirements.

The stock market already considered Trump's improvements, still before he put a hand on the Bible. There is a group of large players without obvious intentions in the market, it generates uncertainty and forces investors to run in treasurer bonds. In the nearest future, Trump's administration is waited by the crisis of currency and bonds, even before the declared positive changes.

Asian trading session began for dollar unsuccessfully. Actually, principal currencies have now no own reasons for growth therefore they just profit on weakness of dollar. We warn those who want to use this distemper: the dollar next week will storm that can be dangerous to short-term transactions.

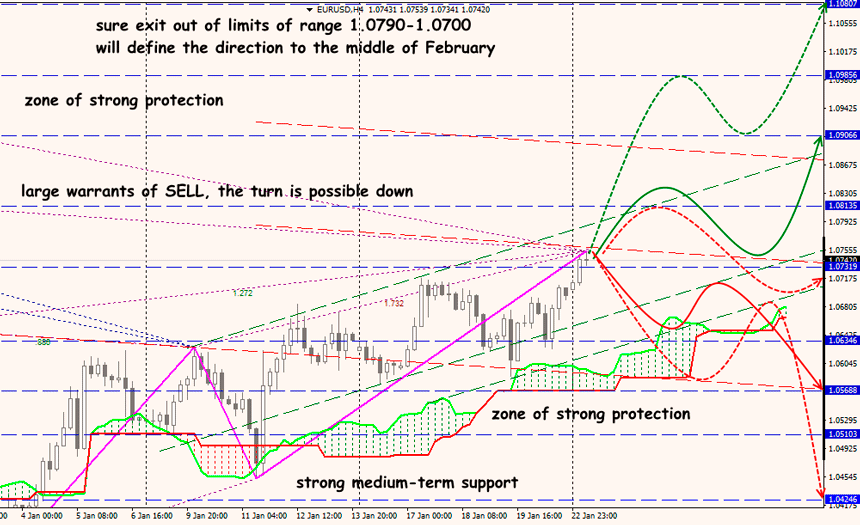

Technical Analysis EUR/USD

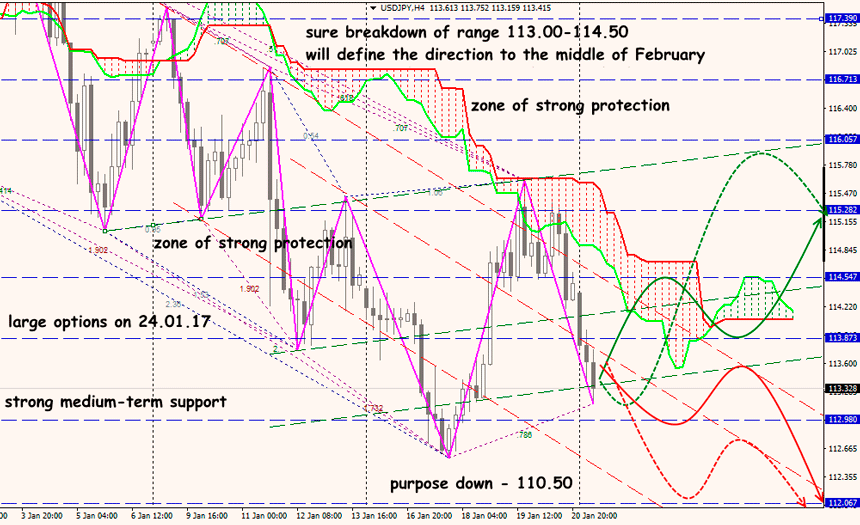

Technical Analysis USD/JPY