God created war so that Americans would learn geography» (Mark Twain)

The situation in China is stable, Japan is nervous, Europe threatens. The market remains active and open for speculation.

Next «Beige book» and May NFP have again shown that the economy of the USA is rather strong to endure an increase in rates though falling of unemployment rates increases risks of growth of salaries in the subsequent reports. But shouldn't wait for the active growth of dollar as confidence in a weak, but stable positive is already put in the current quotations.

A series of reciprocal concessions, after all, has led to the formation of the government of Italy that can be considered a moderate positive for euro. Revision of agreements of Rome with the EU remains on the agenda, but in the current situation, the total coalition can be considered the least negative option. Vote in the Senate on a vote of confidence to a new office is expected on Tuesday.

The new Conte team was already named «active laymans» − more than a half of new officials have no higher education. It is obvious that the Italian program of reform of the Eurozone will be represented at the summit of leaders of the EU on 28-29 June. We will remind, the national debt of Italy makes 132% of GDP (more in the European Union – only at Greece), however, new leaders intend to demand from Brussels of the refusal of strict budgetary requirements to member countries. If Germany refuses reforms (that is the most probable), we can expect aggravation of a situation for euro. The most negative scenario – inclusion in the budget of the next year of issuance of the Italian euro bills that will lead to a repeated wave to the panic of investors of the Eurozone.

The pound continues to suffer from a negative on negotiations of Brexit and insufficient restoration of an impulse of growth of the economy. PMI of services of Britain with the publication on Tuesday can give support to pound, and the government of Britain has to present a viable solution to the problem of the Irish border in the next weeks. So far Davies's proposal on providing the status of simultaneous stay to Northern Ireland in the EU and Great Britain and a 10-mile trade buffer zone along the border is recognized «crude» by euro experts.

If prior to the summit on 28-29 June the program isn't corrected considering wishes of all parties, then an exit of Britain from the EU without new trade agreement and without transition period is possible. And though May's team shouldn't allow such failure, GBP/USD begins to look after for itself the purpose below 1:31.

The USA has raised taxes on steel import on 25% and aluminum for 10% for the EU, Canada and Mexico. Trump considers that negotiations with the EU were insufficiently positive, and he suggests to stop negotiations on NAFTA at all in exchange for separate agreements with Canada and Mexico. But Trump-businessmen, obviously, badly learned history.

Trade wars always turn against those who begin them. Today a considerable part of the revenue generated by the American corporate sector falls to the share of China (for example, Apple sells 20% of the products to China). The situation is complicated by the fact that China is the world's largest sovereign holder of the American national debt, and trade war will surely pull for itself war currency. So far China abstains from the devaluation of yuan as a countermeasure, but is ready to make it at any time. United States Secretary of Commerce Wilbur Ross was in Beijing during a weekend, but there is no information following the results of negotiations.

Washington is already forced to continue negotiations on exceptions of new rules about duties especially as the direct effect of the introduction of tariffs, positive for the USA, for import of metal from the EU, Mexico and Canada is estimated by experts as «limited». Canada will suffer most strongly from duties. The prime minister Trudeau considers the idea that Canada somehow can pose a threat of national security of the USA as offensive.

Canada already drives sanctions on the production since June 10. Mexico has also reported about the introduction of duties on a number of goods from the USA, generally also on food and steel products.

All injured contractors have submitted claims to the WTO. At the moment a negative from this debate small, but Trump prepares the following step: increase in duties on import of cars that will become first of all strong blow for the EU and Japan. Aggressive reaction of partners of the USA in the G7 surely accrues. It is necessary to expect that the summit of the countries of the G7 on 8-9 June will be completely devoted to questions of regulation of trade.

Some short news:

- The prime minister of Spain Rajoy has retired; but the country won't be without the government– his post will be held by the left-centrist Pedro Sanchez who adheres to pro-European policy.

- By preparation of a meeting of Trump and Kim Jong-un, the USA and DPRK have faced a problem of payment of hotel for the Korean leader in Singapore. Besides, rent of transport can be necessary for a delegation from Pyongyang for a flight to Singapore as in Northern Korea still the Soviet planes which don't meet modern standards are operated. The USA is ready to undertake payment of expenses, but any similar payment will be a violation of the sanctions imposed by the USA. Besides, in DPRK can apprehend it as an insult, therefore, North Korean accounts, most probable, Singapore will pay.

- The European Commission intends to bring in the long-term budget of the European Union for 2021-2027 new function of support of the EU countries which have got into a difficult economic situation. The action of the program will extend to the countries participating in the European mechanism of exchange rates (ERM II). The credits guaranteed by the budget of the EU in volume to €30 billion, funds for them will be raised at the open market.

Today Draghi will meet Merkel; Italy will be the main subject and also Frau Chancellor will want to clear rates of normalization of the policy of the ECB, in particular, expiration dates of the program and increase in rates. It is not impossible that they will touch base the question of problems of Deutsche Bank which slowly, but it is sure, turns into the European option of Lehman Brothers. We will remind: the S&P agency has downgraded the German financial giant from A-/negativny to BBB+/stable.

The current week we pay attention to data of ISM of the service sector, productivity and cost of work of the USA; in the Eurozone it is necessary to trace PMI of a services sector and GDP in 1 quarter. China will publish the remains of data of PMI in the morning of Tuesday and trade balance on Friday.

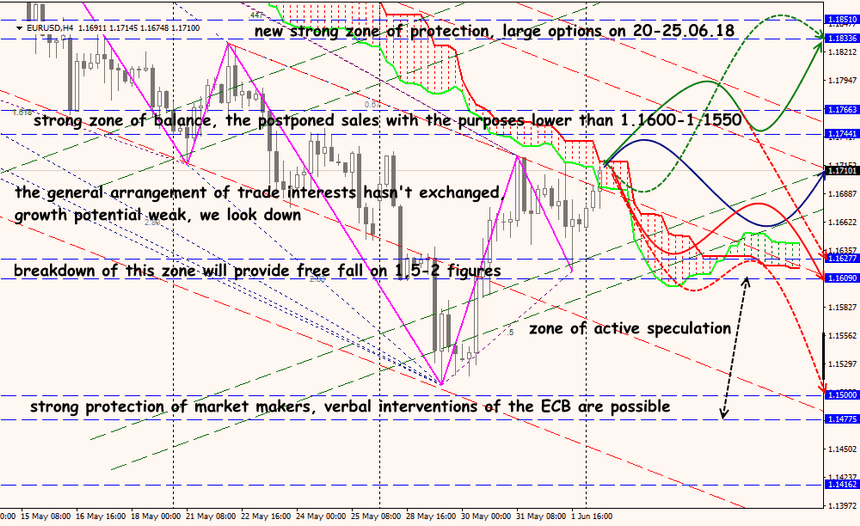

Technical Analysis EUR/USD

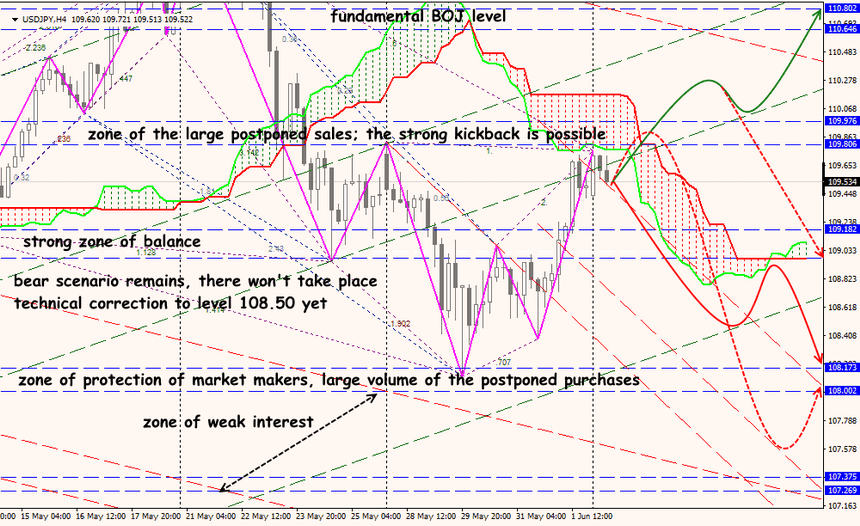

Technical Analysis USD/JPY