Messages from the front: European migration and active export of problems

Trump is at war with motorcycles, and China increases sale of oil for yuan. Truces aren't relevant yet.

In response to the ultimatum which is put forward to Merkel by partners in ruling coalition and as a result of active work in the night from Thursday to Friday at the EU summit the German project capable to solve a problem of the European migrants for the next decades has «unexpectedly» been approved. Creation of the reception centres of refugees in the EU and North Africa under the direction of the UN and redistribution of migrants to other countries on a voluntary basis is supposed; strict control over secondary migration in the EU and increase in the help of Turkey, Morocco and the states of North Africa is also coordinated to reduce number of those who aspire to Europe.

The German political fraus have also agreed: migration policy of Merkel has been supported by CDU in the person of the secretary general Annegret Crump-Karrenbauer yesterday. The conflicts with Poland, Czech Republic and Hungary which are incorrectly specified in the final document as the countries which have supported this project and also (temporary?) problems with refusal of Egypt to create the migration centre in the territory, have to be settled current week. Details, of course, demand coordination, but euro has already actively fulfilled the positive.

Trump is in the mode of an election campaign long ago: the president has announced preparation for revision of tax reform «by October or earlier» though it is obvious that it is impracticable considering the current load of the budget and quantity of fiscal hawks in the U. S. Congress.

The chance of a discharge in trade war after Trump's promise not to suppress the Chinese investments was completely destroyed by the Trump's adviser Larry Kudlow statement –this is not about any mitigation of positions, the president was again «misunderstood». If Beijing doesn't manage to reach the breakthrough agreement at the last minute, then on July 6 tariffs for import of the Chinese goods for the sum of $34 billion will come into force. The economy of the People's Republic of China has continued to be slowed down against the background of toughening of terms for crediting and trade contradictions. Although indicators of the Chinese production have already suffered negative consequences from increase in duties, China actively devaluates yuan, increases a turn of oil futures in yuan at the Shanghai exchange and prepares for full-scale trade war with the USA. Saturday PMI of China have been released within expectations, China will please with PMI remains on Monday and Wednesday.

The Brexit subject remains the main problem of pound, there is no progress in negotiations and the plan of an exit of Britain from the EU without new trade agreement and, as a result, without granting a transition period is ready by now. The meeting of the adviser for national security of the USA Bolton with the British colleague Mark Sedwill and the conservative deputies has reminded the world of force of secret negotiations and obligations. Bolton has let know that Trump is personally ready to accelerate a commercial transaction with Great Britain after Brexit. Especially as the insider from the EU confirms that the scenario of rigid Brexit is more and more probable, considering weak progress in negotiations and a slurred position of May. Problems are added by transfer of clearing operations to the EU which obviously don't manage to finish till March of the next year. At the same time, judging by the last statistics, the economy has shown a positive impulse in the second quarter, having strengthened expectations of the fact that BOE is ready to raise interest rates in August.

It is a little more news – briefly:

- The economic bulletin of the ECB reports that the economy in the Eurozone remains strong and growth continuation is expected, short-term indicators speak about labor market strengthening, basic inflation has to grow by the end of the year.

- Canada announced reciprocal duties on steel and aluminum for the USA since July 1 in the approximate volume of $16,6 billion and allocates about $2 billion for protection of interests of workers and the enterprises of the heavy industry which have suffered from duties of the USA.

- Iran has found a hole for a circumvention of oil sanctions: permissions to oil export by the national private companies. Such deliveries won't fall under restrictions of the USA and their allies. Near 60 thousand bars/days of the Iranian oil are already offered on open trading floors. There is no Trump's reaction yet.

- Extension of the agreement of OPEK+ and activization of statements for future sanctions against Iran have caused, contrary to analysts, rapid increase in prices on oil. So far Trump wrote tweets with one hand, and another shook the fist to Harley-Davidson, the North American grade has updated a maximum at the exchange in Chicago, and, in response to it, gasoline in California has taken the level of $3.25 for gallon.

- According to the insider, India and China can support the USA and refuse oil of Iran only provided that supply of oil will grow, and the price won't exceed 80 dollars. Trump only have to persuade partners in OPEK+ to keep this level.

Activization of trade war remains the main factor of the current week, the quality of NFP will only correct the direction of capital flows out of the stock markets. Today is holiday in Canada, and the exchange world of the USA has a rest on 3 and 4July; and only by Friday we will see events which will give the movements in the market.

On Wednesday we read attentively protocols of FRS. Reminder: the accompanying statement and new forecasts from a meeting of FRS on 13 June were very hawk; forecasts for growth of inflation have been raised. Moreover, Larry Kudlow and Powell's current active «consultations» are treated by analytics as attempt of open pressure upon FRS. In the light of the Friday statements of Kudlow, investors first of all will look for in the protocol of FRS the instruction on factors which can lead to delay of rate of increase in rates.

The opinion of the market will depend on economic data. Before the publication NFP there will be all data which will help to get an indirect impression about labour market force (ISM of the industry and services, the report of ADP), but the main reaction of the market will be on growth of salaries.

On the Eurozone it is necessary to trace PMI of the industry and services and unemployment rate; we pay attention to the publication PMI of the industry and services.

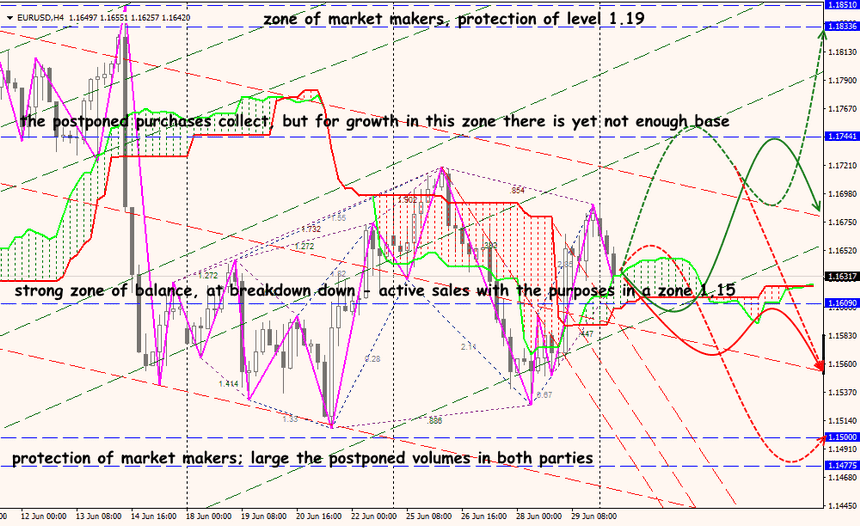

Technical Analysis EUR/USD

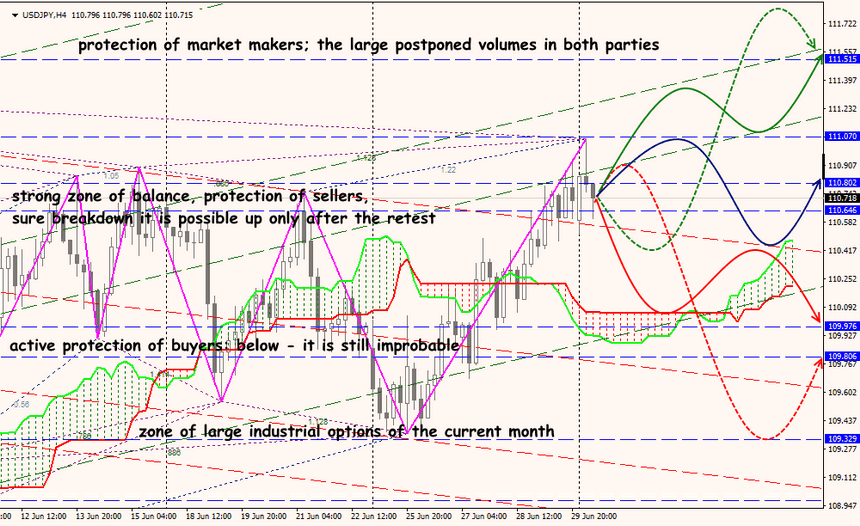

Technical Analysis USD/JPY