2016: Results and Implications

Last year became the global crash-test for the world economy and the markets therefore are difficult to surprise with something. As a result the dollar is still stronger than the other currency especially because the euro will be concentrated on policy and financial risks next year, and the pound will continue to follow the developments around «divorce proceeding» of Britain and the EU. We will talk about plans for the future next Monday for now we remember the main painful points of the expiring year.

FRS. All year actively resisted, carefully prepared the appropriate fundamental background and only after Trump's victory decided to make one increase instead of the promised three increases - in December. For 2017 three increases in a rate are declared again, and the markets consider 30% probability of the first increase in March. It means that special attention should be paid to any statistical information on dollar.

BOJ. For the first time in the history to introduce a negative interest rate as a measure of fight against deflationary processes, and moreover it began to publish an interest rate officially. This fact against the background of additional and fixed issue already for the first half a year brought down yen on 400 points. Changes in monetary policy have not planned yet, and USD/JPY will be within 120.00 - 121.00.

ECB. Entered into 2016 with 0,05% refunding rate, and in March 2016 lowered it to a historical minimum of 0,0% and keeps at this level to this day, and a principal theme for the markets is the destiny of the program euroQE which is used in parallel with zero rates.

RBNZ. For 2016 the Reserve Bank of the New Zealand carried out three decreases in a rate - to a historical minimum - 1,75%. The rate is really extremely small, and the first decrease became absolutely unexpected for the markets. At the moment the situation changes and RBNZ next year can back drive.

RBA. Because of the additional pressure of the labour market, Australia today - the first in a queue on interest rate reduction.Brexit. The last half a year it has been already told and written much about it. As a result of absolutely inadequate decision of British people the pound lost 20 figures, the country − the highest credit rating, and it was necessary to replace the prime minister and to lower an interest rate.

«Flash Crash» on pound. One morning traders lost 500 points on pound (and some brokers - 700). This situation was explained by engineering problems with trade robots which initiate sales if the price of an asset reaches a certain level, and also by a sharp reducing bank positions and, as a result, a reduction of the liquidity in the market. You shouldn't forget that trillions of dollars which are daily walking in the financial markets - an excellent target for cybervillains and someone earned big money on it.

Eurozone. Main issue: whether weak euro can save an economy even though the data on inflation already show the availability of the positive effect. Austerity measures, the improbable cost of the aid program of Greece and to other countries of PIGS, the politician of migration and terrorist attacks led to activization of antiglobalists. Today preserving the Eurozone requires change of policy of Germany and France, but for this purpose it is necessary to recognize at first existence of problems, and then to find a method and political courage for their decision.

Entering of single eurobonds could solve the majority of economic problems, but Merkel furiously opposes it. It is necessary to wait for election promises which will help the European leaders to correct their aggressive line items. According to the OECD forecasts, the economy of Europe can increase by quite good 1,6% next year. Much more a big threat for the eurozone will be posed by politics, terrorism and bank crisis.

Italian crisis. Today the situation in Italy is assessed incomparably more seriously, than even an economic depression in Greece. The Italian government is ready to pump €12 billion in Monte dei Paschi di Siena bank to implement the plan of recapitalization.

Deutsche Bank. The largest German bank’s story can remind itself right after New Year. Deutsche Bank which was affected by write-off of bad debts, losses from trade in derivatives and inefficient management shall find means in the amount of €5 billion ($5,2 billion) till December 31 for the increase in the equity to avoid a real liquidity crisis such as was in 2008 and to pass «stress tests» of the generous European Central Bank. If it is required, the government will pour in it €15 billion, but this story is still far from the completion.

Trump. Everything which is connected with the unpredictable and odious republican - elections, a victory, an inauguration, foreign and domestic policy - is a strong irritant for the financial markets. Expectations of results from the fiscal policy declared by him are extremely high. But implementation requires time, and moreover initiatives of the president can be strongly weakened by the Congress, especially when it comes to the issue of the public expenditures. Furthermore, demography and low labour efficiency are capable to interfere with the development of economy to the level of 3-4% expected by the new administration.

After Trump's victory the large equity holders believe that the economy will grow at the pace above an average and inflation will rise, and the companies will earn more. For this purpose they invested in shares and considerably reduced the presence in the bond market.

China. Irrespective of a market situation, Trump is ready to announce China as «the currency manipulator», and, most likely, it will occur in one of «the first days» of his official activities. The increase in customs tariffs is not distant and therefore the next devaluation of the Chinese yuan is most probable in the first weeks of the new year not only because of manipulations of the government, but also as a result of panic capital outflow from the country (about $100 billion a month). The People's Bank of China already lost more than $1.5 trillion currency holdings within the last two years, trying to provide demand for dollars. General reserves of the country decreased from $4 trillion in 2014 to $3,1 trillion for today. It is possible to use no more than $1 trillion out of this amount on protection of yuan exchange rate as about $1 trillion allowances are in an illiquid form, and $1.5 trillion will be required for bail-out of the Chinese banks during the upcoming credit crisis. However, if China after all decides on the maximum devaluation, then 11% fall of a rate in 2015 will seem to the markets an easy picnic.

Gold. Gold is not simply an insurance from the inflation, it always becomes demanded in the period of political instability. Next year the prices of a precious metal can go up, facing the background of growth of inflation expectations after the American elections and an aggressive attitude of Trump towards Iran and China. Anyway gold remains the excellent indicator of fundamental tendencies.

In the process of approaching of holidays the market becomes inconsistent - movement of the price reflects fixing of profit. At the same time correction of the American currency still has limited character as most of players continue to bet on the USD. The last splash in activity is possible on Tuesday and the market thereafter completely will go to the festive mode. Most likely, the period of strange correlations has finished, and the markets after all will go in that direction that will set a dollar index.

We remind that holiday reduction of the liquidity causes «empty» and extremely dangerous volatility, and normal activity will return on the market not earlier than on Friday together with the publication of the NFP for December.

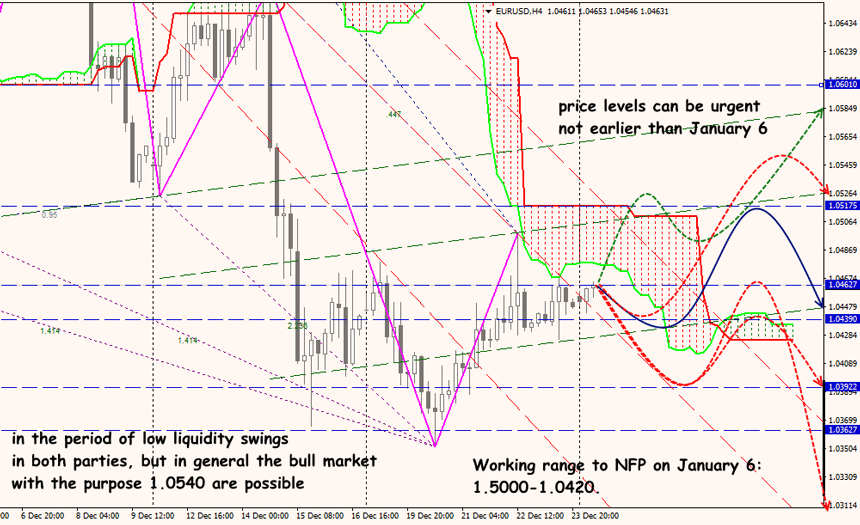

Technical Analysis EUR/USD

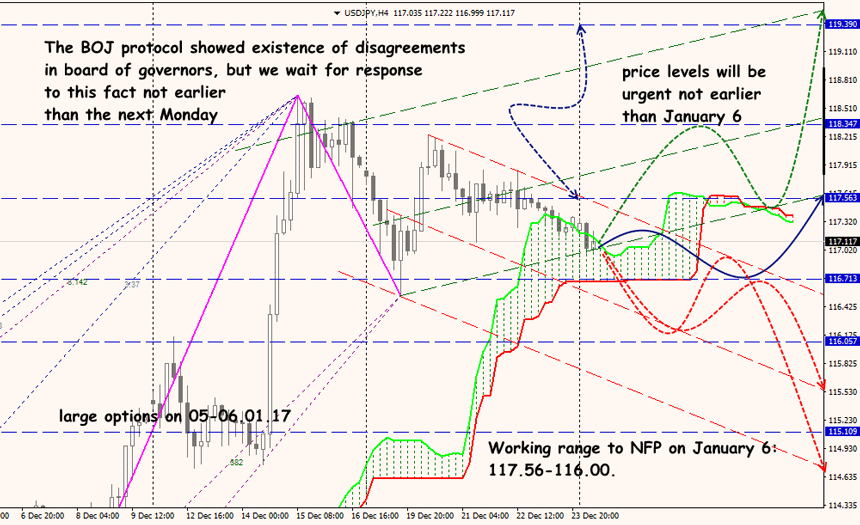

Technical Analysis USD/JPY