Trump's magic as reason for speculation

Trump actively discusses, threatens and comments. The Bank of Japan made the decision to keep monetary policy without changes, Europe prepares for the new debt crisis in Greece, the parliament of Britain supported the bill of the start of Brexit in the second reading. But America in the current market - first of all.

Today Trump's twitter threatens long-term trade alliances. The basic slogan MAGA (Make America great again) becomes an urgent market factor, especially – still nobody knows, what does it mean. Even Trump whose protectionist policy promises higher consumer prices what now Americans aren't able to afford. Official inflation in the USA − the highest since 2011. The markets can sell shares only as a result of a strong sense of disappointment, and then the purchase of state bonds of the U.S. Treasury will lead to a depreciation of the dollar.

This week president Trump and his colleagues have a strike to some closest friends. It`s about the «stupid» agreement on the distribution of refugees with Australia and accusation of Japan and Germany in a manipulation the currencies. The dilemma is the partners can't understand: such behavior of Trump is a part of tactics or the beginning of large-scale recutting of a world order. It is just in case recommended to prepare for the worst.

Anyway, all partners of the USA are ready to battle for the interests. According to the habitual economic theory, Trump's plans for stimulation of the American economy due to the growth of expenses in infrastructure, reduction of taxes, and also the input of new customs duties on import, just shall lead to the growth of the dollar and to the expansion of trade deficit of the USA. As a result, the new president can issue more aggressive reaction in the direction of trade, especially with China, Japan, Mexico, South Korea. The financial markets need only to guess who will become the following object of the fight for competitive advantage.

On Friday the next «good» bad Non-Farm is published: a quantitative surplus of employed is positive, but the quality of the labor market − doubtful as compensation is lower than the forecast. However, large players continue to gain euro liquidity and buy up euro, but they will be ready to hand over only at the levels above 1:15. Now the market adequately reacted to data and the increasing pressure from new Presidential Administration, and also doubts concerning the speed of increase in an FRS rate left the dollar under pressure.

BOJ didn't allow active games in the debt market – speculators were punished rather aggressively, the regulator carried out large-scale intervention. The Central Bank suggested everyone to sell it an unlimited number of bonds on fixed price, that is with the 0,11% profitability. As a result, the purchasing amount of bonds with repayment periods of 5-10 years was increased from ¥410 billion planned earlier to ¥450 billion ($4 billion). Current week Trump's meeting with Shinzo Abe is planned, we will hope that as a result of discussion Trump will declare that strong Japan − for the benefit of today's America, and it will mean permission to the depreciation of yen.

The Bank of England keep on an upward interest rate trend, the pound keep under pressure because the published inflation report didn't contain essential changes, PMI indicators decreased, the plan of Brexit with the schedule of country`s leaving the EU is published. Hearings in committees of the English Parliament will take place from February 6 to February 8 inclusive, then one more round of a debate in the House of Commons, then vote on the third reading, further − consideration in House of Lords (whole document − less than a half of the standard page).

If Great Britain completely abandons the single market of the EU in 2019, then for credit institutions it means certification loss, therefore, large structures plan the moving from London to other financial centers and actively look for new information hubs. In Ireland with its low taxes, it will be simpler to provide access to the market of the block, therefore, industrial companies can stop the choice on Dublin, while Goldman Sachs, Citigroup Inc. and Lloyds Banking Group Plc take a closer look at Frankfurt, where Deutsche Bank AG, ECB and BaFin will be the neighbors. For London it means loss of 35-50 thousand workplaces.

From other news we will note:

- George Soros celebrated the 53rd year as the investor by large loss of client money. Soros Fund Management following the results of the 2016th became one of the worst among 20 world hedge funds. Having returned last spring to independent trade in the markets, it unsuccessfully tried to play on fall of shares against the background of Brexit, then on the American industrial shares. The legendary billionaire already lost more than $1 billion, or 3,5% of assets, but, nevertheless, most its unprofitable transactions on gold and S&P500 aren't closed yet.

- Large players of Wall Street stake on gold in spite of the fact that this asset is considered the least successful asset from the moment of Trump's election (outflow of assets from the largest gold exchange fund SPDR Gold ETF is $30 billion). Strengthening of the volatility of the stock market because of Trump's policy and the upcoming elections in Europe is expected, especially as the new president didn't disclose details of expense plans yet. It shall weaken the dollar and will cause a speculative increase in prices for gold.

- The European creditors are ready to lower hostility degree in the Greek negotiations in anticipation of elections in the key countries (Netherlands, France, Germany), but aren't ready to decrease in a debt load yet, at least, the requirement of primary surplus of the budget in 3,5% of GDP isn't cancelled. Ministers of Finance of the EU will continue negotiations at a meeting of the Eurogroup on February 20.

The current week the release of interest rates from Australia and New Zealand, on Friday the Canadian NFP is expected. It is worth paying attention to the publication of economic forecasts for the EU, the monthly report on employment of Great Britain and data of the USA on a trading balance for December. In general, except yen, strong speculation isn't expected, but active comments to which it is worth listening are possible.

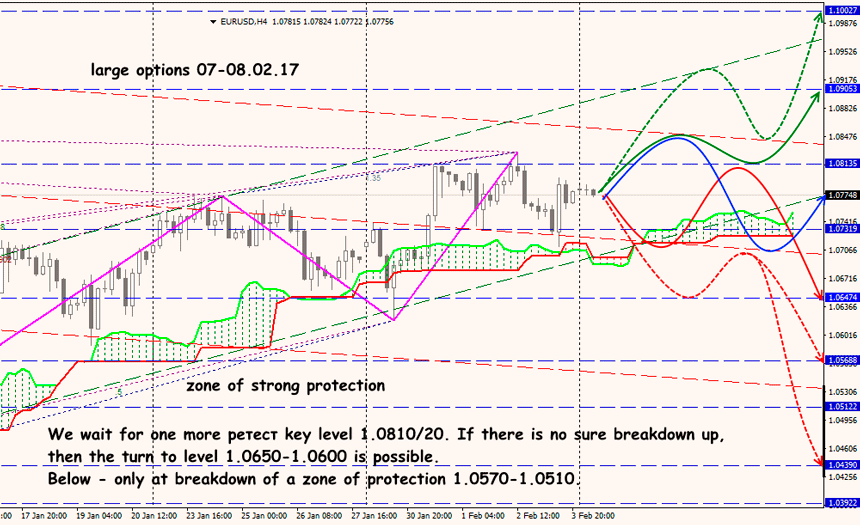

Technical Analysis EUR/USD

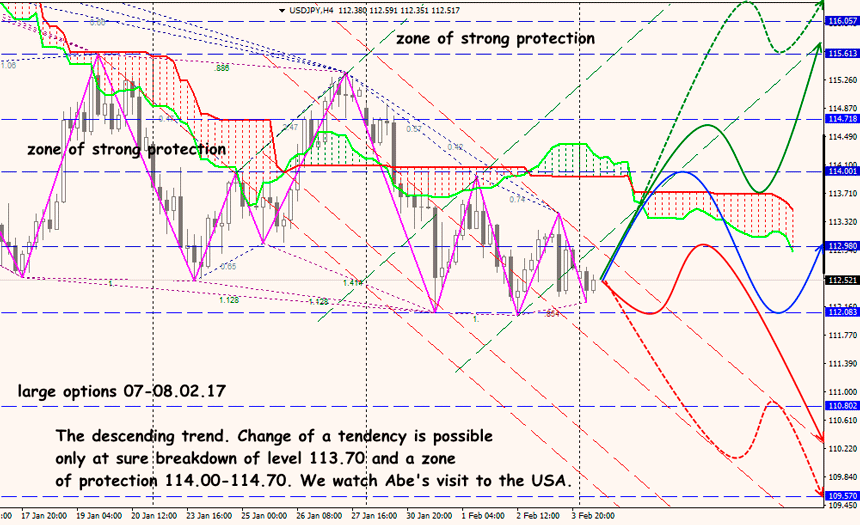

Technical Analysis USD/JPY