The closer the FOMC - the more angry speculators

Italy voted, the ECB reported, Brexit will be not later than March 2017, with all agreed upon oil, the dollar grows, the others - actively falls. We wait for the last performance from FRS. Ahead completion of trade year, activity in the market is off the charts, and for earnings on it there are no more than 10 days.

As expected, Draghi became the chief conductor of market panic. Tapering mirage became a primary impulse for fall of the euro: the last straw - article in Reuters that the regulator is allegedly ready to hint at a possibility of narrowing of the program of incentives. As a result, though the ECB also left all three interest rates without changes, contradictory information on structure euroQE was apprehended aggressively: on the one hand, the program of stimulation was prolonged, but its amount was reduced that excited market bulls. In addition to prolongation of validity period of the program till December, 2017, the regulator made changes to the capital key rules - in January is planned to make shorter a repayment period available to bond purchase from two to one year, and also to cancel an interdict on purchase of papers with profitability below current rate on deposits (now it constitutes -0.4%). Such step shall solve a problem of shortage of the bonds available to purchase.

Everything looks beautifully, but you can't put anything over on the real skeptic. If it is planned to keep the sparing monetary policy - why to reduce the speed of QE? And the matter is that the ECB would continue the buying up with a speed of €80 billion a month, it would reach a limit in 33% for the issuer upon Germany by the beginning of summer, and upon Italy - in the fall. The situation when the Central Bank holds on balance a third of a national debt of any country seems absurd, but to strengthen this absurdity further means to exceed all framework of financial discipline. Of course, such participants as Germany quietly realize the bonds without purchases from the ECB, but such as Italy where the relation of national debt/GDP is at the level of 133%, use this situation as regular monetization of the debt at the expense of other participants. So they shouldn't turn QE obviously so far.

Speculators outgamed all economic and political analysts again. After minute nervous "thorn" the market thought again, and then SuperMario and his colleagues made every effort that the market didn't have an also shadow of doubts that you can see no end to incentives yet. If briefly - the ECB believes that urgent measures within euroQE positively influence the economy and help it to be recovered, even inflation at last rose − to 0.60%. The market expected approximately such decision, and the ECB needed fall of euro − and after the phrase "closing of the program wasn't discussed" the way down became free. The following key purpose – parity to the dollar.

After the presidential elections in the USA pass away a month already, the dollar already grew by 4.3% that gives foreign companies short-term price advantage over the American competitors. The American exporters note that their goods and services in many markets became much more expensive, and revenue was reduced in conversion to the dollars. The voiced idea of republicans to realize tax benefits to induce the American companies to repatriate of profit looks a new reason for the growth of dollar. However implementation of this program requires decent time, but Europe already won together with Trump, and it is only a part of those benefits which it can obtain. Trump promised to reduce taxes (in particular, a profit tax of corporations from 35% to 15%), plans for subsidizing of investments into infrastructure and increase in military expenses are considered, that is in the nearest future the growth of fiscal deficit and the consumer demand of the USA is provided.

On Wednesday will be the next step to a discrepancy in monetary policies of the ECB and FRS whose last meeting will become the key afternoon for completion of trade in 2017. Players will actively work any variations on the future fiscal and budget policies of the USA: it is rather difficult to current FRS to adapt to new factors and threats of «Trumpoeconomy». Now one increase in an interest rate a year is obviously not enough.

In general, the Federal Reserve is ready to become more aggressive if Trump keeps the promises about fiscal incentives and by that will provoke inflation growth. The markets wait for real steps from the new administration of the USA, but if on Wednesday plans of the Federal Reserve are corrected for benefit of more vigorous increase in rates, then the dollar will receive the next feed for local strengthening before New year. And then first of all the euro, sterling and yen will be under the largest pressure. But even if FRS will change nothing in the plans and will prefer to observe of events, then the negative impact on the dollar will be very limited.

From other news we will note:

- The High Court finished four-day hearings according to the appeal on the judgment of the court of lower jurisdiction that Brexit's procedure shall confirm by the parliament. Besides, Davies, the minister of an exit of Great Britain from the EU, declared that the government is ready to think of paying for access to the single market. On Wednesday the parliament approved the periods for application to article 50 of the Lisbon agreement offered by May, but hardly this news will be able to affect dynamics of the pound which will be determined more by general moods by the dollar.

- Somehow absolutely imperceptibly for the market in Austria the new president was elected − the former Green party leader Alexander Van der Bellen and though his status assumes mainly ceremonial functions, the current vote was considered as an additional barometer of discontent of the European voters. The Austrians voted against the far right candidate as trust the famous moderate politician more than to the aggressive populist.

- Italy voted against reforming of the constitutional system − the country requires changes, but not the preservation of the current problems. Renzi retires, Moody’s lowered the estimation of rating of Italy from Baa2 to negative, referring to the low and constantly interrupted progress in economic and fiscal reforms. Recapitalization of a bank system of Italy with the participation of the ECB is postponed until the middle of January. The Italian foreign minister Paolo Gentiloni accepted the proposal of the president of the country Sergio Mattarella to become the prime minister and promised to create the new government in the shortest possible time.

- The Eurogroup is ready to reduce in the short term a debt load by Greece, including simplification of the payment schedule to ESM fund, refusal of penal coupons, the change of floating rates to fixed, all this shall lower national debt/GDP ratio by 20 percent points till 2020.

- The agreement on reducing the amount of production in comparison with levels of October 2016 by 558 thousand bars a day became the result of long Saturday negotiations in Vienna in which, in addition to OPEC, 11 manufacturing countries which aren't entering into cartel participated. The extremely interesting statement was made by the Oil Minister of Saudi Arabia Khalid al-Falikh about readiness to reduce production lower than 10 million bars/day and, depending on market conditions, it is ready to bring the final amount of reducing to 1.82 million bars/day.

- The first step of foreign privatization: 19,5% of shares of state-owned company «Rosneft» are sold to two foreign investors – to the global trader Glencore and a sovereign fund of Qatar - the Qatar Investment Authority (QIA). The transaction is already closed at the price in €10.5 billion, at the same time Glencore in comments reported that the most part of its investments will be constituted by the raised funds which aren't received yet, and determined transaction price in €10.2 billion. Consequences of this transaction are only studied by analysts so far, but anyway, this money will be included in the Russian budget until the end of the year. Rosneft providently borrowed 600 billion rubles in the market.

Pre-New Year's money is wanted by all, therefore, the main recommendation in the current market – caution. In addition to FRS, the current week you should pay attention to retail sales of the USA and Great Britain, and also a meeting of the Bank of England.

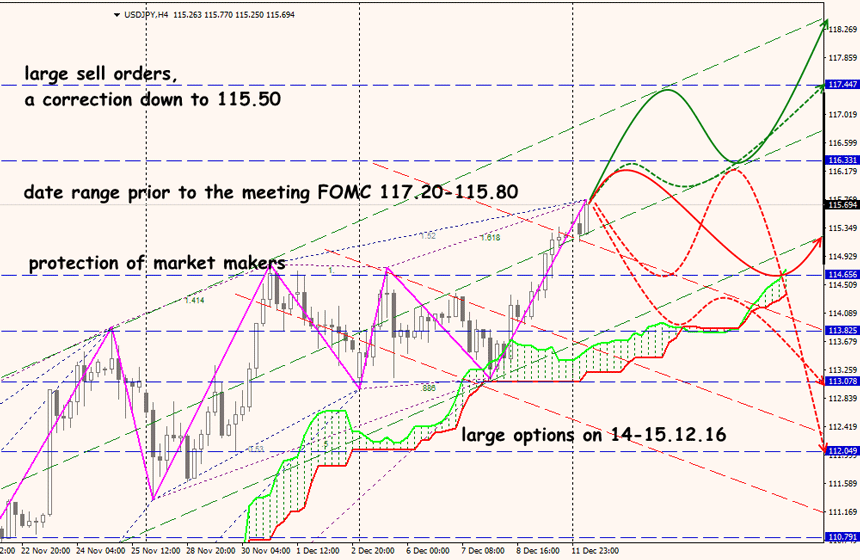

Technical Analysis USDJPY

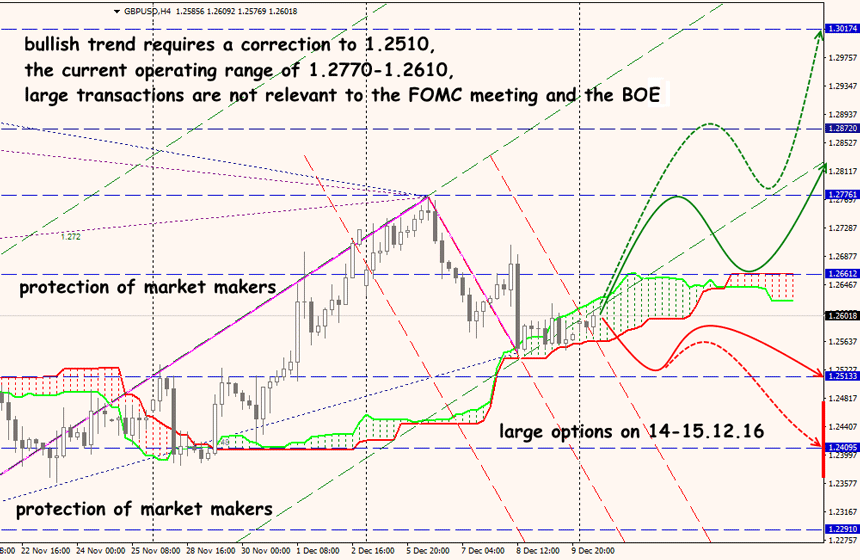

Technical Analysis GBPUSD