Candidate vs President: Trump changes rules of the game

The new U.S. President begins to build walls which are promised before elections. «Hawks» of ECB declare need of reduce euroQE, Yellen hardly restrains from obvious opposition. Great Britain prepares for the worst, May prepares the new base for the British corporations which will survive Brexit without serious consequences.

There is an impression in a dollar exchange rate problem the worst enemy of Donald Trump is Donald Trump who considers strong dollar a burden for exporters and an obstacle in a way of stimulation of growth of employment in production, but at the same time his actions, as well as the suggestions of his allies in the Congress, lead to strengthening of dollar.

In addition to the advertized wall on border with Mexico, the closest advisers of the new president are frightened by the speed of acceptance of organizational and finance solutions by him. One more agreement on trade without rates and restrictions - NAFTA (North American Free Trade Agreement) with Mexico and Canada is subject to revision in the nearest future. Not only NAFTA, but also the agreement with the European Union (Transatlantic commercial and investment partnership) which partners on both sides of Atlantic only just began to approve, will be the future victims of Trump.

America too quickly moves towards an isolationism and destruction of the stated free trade areas at the expense of what economies of other countries grew. Trump accurately told that an end will be put to it, and is going to build trade policy on the basis of the bilateral relations.

Trump signed orders concerning renewal of a construction of the Keystone XL pipeline (Canada-USA) which was a stumbling block between the Senate, environmental organizations and personally Obama, and held a meeting with the General Motors, Ford, the Fiat Chrysler, having inspired them on production in the USA. As a result, S&P500 added 0,66% and expected long consolidation of the stock market already questionable - the market is ready to growth. Besides, the USA began supply of slate oil to Japan.

The decision of the Supreme Court of Great Britain on start of Brexit process only in case of approval of parliament was made by 8 voices of judges from 11, but the consent of Scotland and Wales isn't required at the same time. The parliament will be entitled to vote any agreement with the EU, therefore, consideration at the level of legislators raises trust from investors.

The overview of business conditions from PricewaterhouseCoopers showed that conditions in Great Britain − the worst since December, 2008. Heads of the British banks recognized it will be difficult to keep clearing houses in Great Britain, but, nevertheless, ask the foreign partners to postpone plans for withdrawal of head offices from the country. At the exit from the EU the British producers can lose up to ₤80-90 billion a year, therefore, Great Britain looking for new trade and economic union where there will be a free market - the Middle East or Southeast Asia was considered - but Trump with the triumph rushed into these plans.

May and Trump perfectly supplements each other: Britain can help with opposition to «the Chinese threat», besides, it hopes for economic cooperation - London needs communications with the USA especially now. Trump actively supports Brexit and is ready to pressure the doubting colleagues, its populism seriously clashes with the EU and global values of Europeans. May has very weak negotiation position in the EU; most likely, she will have to agree on two years' torture by negotiations to provide the maximum access to the European markets, but at the same time to get rid of all corresponding liabilities. London fight for money – it wants to run away, without having paid the bill (about €60 billion − more, than Britain annually spends for defense industry). Europe plans to force to finance pension maintenance of the British personnel in the EU, and will hold Britain to a victorious point and to blackmail with rates until it pays off debts to the EU.

The truth is the discussion by May and Trump of joint plans – an obvious violation of the law of the EU. If two strong leaders actively declare progress on the matter − it will extremely positively affect dollar. If the USA will be the first who signed the bilateral trade agreement with Great Britain, it will become a vote of confidence for an exit from the EU and will force other countries to be adjusted on an exit from the Eurozone.

Opposition between FRS and new administration accrues. Trump won't back, and everything that will remain to FRS, – to fight desperately, toughening the tax environment. Of course, there is a chance that Trump will dismiss Yellen and will find someone with more «hawk» views as he is convinced that low interest rates kill economy. Nevertheless, what sense to dismiss the person who can be accused of all the problems?

Trump will continue to insist on increase in financial stimulation, and Yellen & Co. will continue to insist on monetary policy toughening, and such interaction between the president and FRS doesn't promise anything good for the bond market, gold and other goods.

- After an exit out of transatlantic partnership, Trump − on the one hand − gave to China the chance to keep a role of the leading player in the region, and with another − salvaged the American producers from the competition to cheap Asian import. The head of China Xi Jinping at a forum in Davos declared that China is ready to take the place of the leader in questions of free trade if it isn't interesting to America any more. The largest Chinese companies included in structure of the MSCI China index have a lesser dependent on the American consumers, than the company of the USA – on the Chinese clients. America provides over 10% of revenue of less than 2% to the Chinese companies included in an index though their shares first of all will suffer as a result of a trade war.

- News that the public pension fund of Japan plans to increase investments into the American high-profit long bonds quite strongly influenced the market. The Bank of Japan missed the expected purchase of short-term bonds, caused growth of their profitability and 2% fall of a yen rate. Experts consider thus the regulator prepares for narrowing of the program of stimulation though BOJ strenuously denies this information.

- In the open publication on the website of the Dutch regulator (accidentally?) there were details of hundreds of transactions of hedge funds, including transactions Soros and Medallion fund of the Renaissance Technologies company against the Dutch banks. After financial crisis the European rules oblige hedge funds to open the short positions, but only information on positions in amount more than 0,5% of a total quantity of shares can be public. Transactions of a George Soros family against the Dutch bank ING appear among the published transactions earlier not opened, which was organically combined with the public transaction against the German Deutsche Bank. The position against ING was open in June and was 0,3% of outstanding shares on amount.

- Greece isn't ready to adopt the law on reforms for 2019 and didn't satisfy enough conditions in order that the international inspectors returned to Athens, as it`s required by the IMF. The fund believes the structural reforms in the labor market, in the sphere of provision of pensions and the taxation are insufficient, and also considers a debt of Greece extremely unstable, and suggests to extend this debt to the EU till 2070 on low rates.

The dollar becomes stronger on the way to important levels of support on the USD index, and also before events of the next week. It is recommended to monitor correction of principal currencies, statistical data and the statement of FOMC on Wednesday. It is improbable that FRS will raise a rate. More important event waits for us two weeks later: Yellen will act in the Congress. Considering the growing political pressure upon FRS, this performance finds the additional importance. Already in the nearest future investors will pledge in quotations a factor of «hawk» rhetoric of FRS at a February meeting of FOMC which will increase chances of increase in a rate in March and will give acceleration of profitability of treasury bonds. We don't forget about the first NFP of the current year and the English data on Thursday.

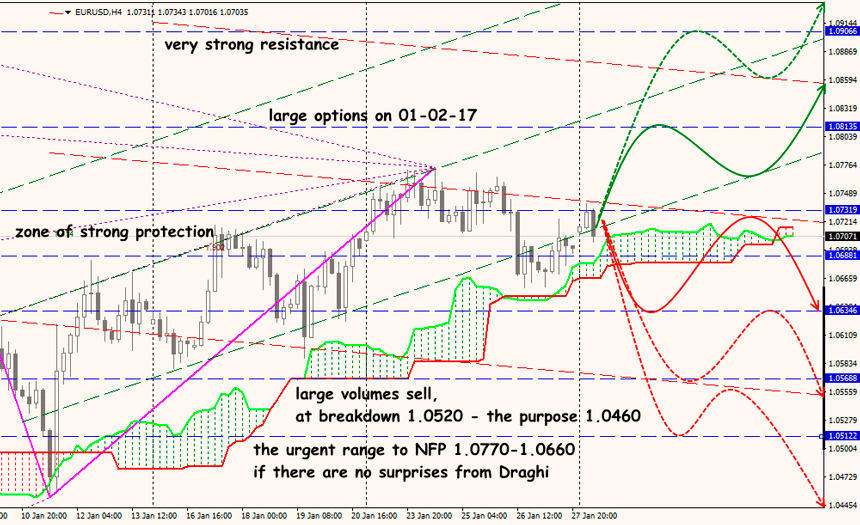

Technical Analysis EUR/USD

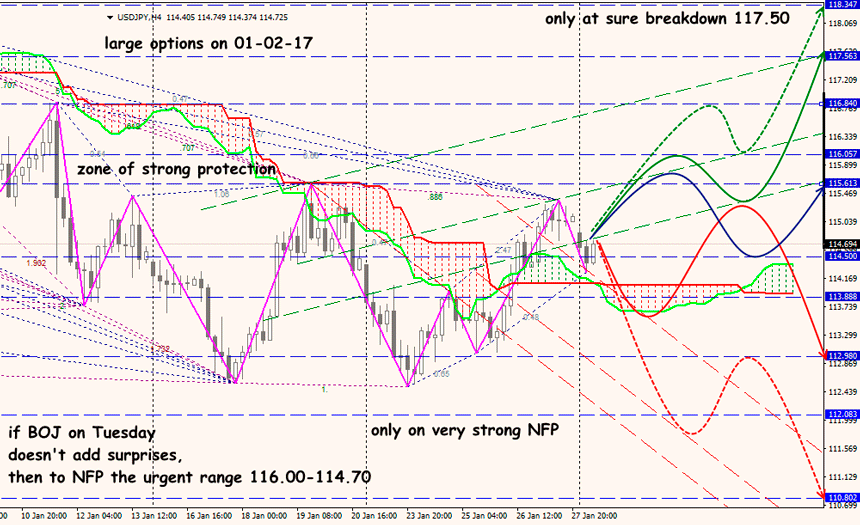

Technical Analysis USD/JPY