The market of lost hopes

Any of processes of trade negotiations hasn't shown progress. Last week would be absolutely boring if not $22 million the defendant Manafort. The ECB and Drags haven't given the markets new information. Optimism concerning inflation growth, generally – thanks to growth of salaries remains, protectionism of the USA remains the main risk for economy; forecasts are corrected slightly. Increase in a rate of the ECB isn't expected till March, 2020. On a question of Italy Draghi has said that the mandate of the ECB is price stability, but not monetization of a national debt of the countries of the Eurozone so evroqe after all finishes until the end of the year. Growth of euro on Thursday has been provoked by the decision of the Central Bank of Turkey and delay of growth of inflation in the USA.

In war of Italy for the budget with deficiency, to the corresponding rules of the EU (it is lower than 3%.), the first victims are outlined. If Tria keeps the post, and the budget deficit will coincide with his promises in the range of 1,5%-1,8%, then euro will receive a powerful incentive to growth; while his resignation will lead to steep decline of euro for 1,5-2 figures. However the current draft budget offers financing only of 40% of the minimum income of citizens: the new conflict «helps» Salvini who actively upgrades the rating due to fight against immigrants. – on September 27, but if resignation of the Minister of Finance is, but her it is logical to sound a project term in parliament current week.

The program of the upcoming September 20 summit of EU leaders has two main themes: the already familiar Brexit and the development of a new strategy in trade negotiations with the United States. Barnier's optimistic statements led to purchases of British assets, but the optimism of markets is excessive and the basic positions of EU leaders towards Britain are unchanged.

EC began to review the protocol on the Irish border just to make it politically more acceptable to the UK. The fate of the Prime Minister depends on the concessions of the EU: if May does not return from the summit with a victory, then by the end of the year one should expect the resignation of the government and early elections to parliament. For the current prime minister, the chances of losing the post of party leader at the October conference of the Conservative Party are very high, and Johnson's candidacy for Europe does not suit. At the same time, London is preparing a second batch of consultative documents prepared in case of failure of negotiations.

Further the main events – it is short:

- Trump has rejected the offer of the EU on mutual compensation of duties on import of a car – now he demands decrease in trade barriers in the sector of agriculture with cancellation of subsidies that is unacceptable for many EU countries, in particular, of Germany and France. Leaders of the EU need the active program, but the decision will be difficult, in the absence of achievement of a compromise the European Union will appear under the threat of disintegration what, actually, Trump also tries to obtain.

- Paul Manafort has found himself completely guilty at all points charges of collusion against the USA and conspiracy with the purpose to interfere with justice. His transaction with the special prosecutor Robert Müller, except active cooperation in a subject of shadow financing «the project Trump», assumes transfer to the state of the property rights to the real estate for $22 million. Now for Trump the main thing − to constrain discussion of a question of an impeachment in the Congress till November 6.

- Optimism concerning NAFTA has practically died. Trudeau has made concessions concerning the dairy market, but for signing of the agreement Canada wants saving article 19 on resolution of disputes. The most informed negotiator Friland considers that at the current dynamics of discussion performance of a deadline till September 30 is impossible. The new round of negotiations opens today.

- A new plan for duties on Chinese goods worth $ 200 billion is ready, but not yet announced. The level of duties is reduced from 255 to 10%. Despite the fact that the parties agreed to negotiate trade disputes, Trump's exit with such a decision to the public is quite likely today.

- China is preparing to fight − Asians know how to wait. Trump is used to assess his success in terms of the dynamics of US stock indices, but he does not understand the mechanism of China's retaliatory strike. Destruction of corporate supply chains in the US will lead to an inevitable collapse of Wall Street and the first signals are already coming from Apple, Cisco, Qualcomm, Texas Instruments and General Motors.

- On September 23, a meeting of the OPEC + committee will take place, but before the end of the year the agreement on oil production is unlikely to be canceled. A sharp increase in oil production is expected next year. The hurricane season in the US and the approach of deadline for the imposition of sanctions on Iran's oil exports keep prices at a maximum, at least until the emergence of a clear positive in the US-China talks.

People from the Federal Reserve go into the «silence» regime before the September 25-26 meeting. Draghi will speak on Tuesday and Wednesday, but the themes of performances are far from monetary policy. To date, the ECB does not consider it necessary to adjust the market reaction.

This week, pay attention to the production index of the Federal Reserve Bank of Philadelphia, construction reports, PMI of industry and services in the US; for Eurozone − a report on inflation in September (the revision of core inflation is not excluded) and PMI of industry and services. Interesting topic Brexit it makes sense to heed the British reports on inflation and the volume of retail sales. BOJ will announce a decision on the interest rate; the beginning of US trade talks is scheduled for September 21.

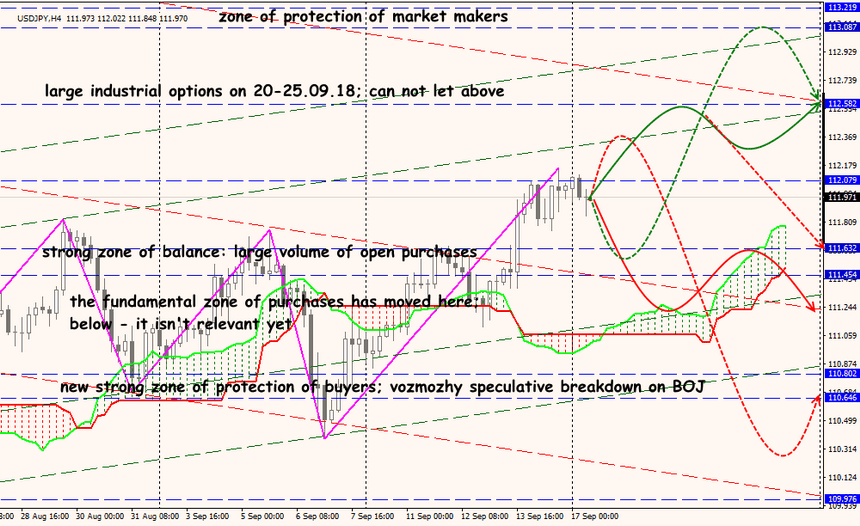

Technical Analysis EUR/USD

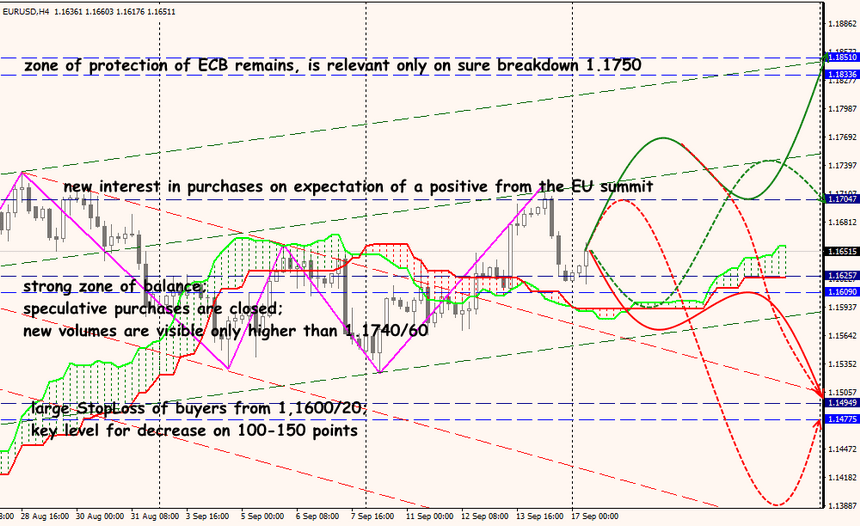

Technical Analysis USD/JPY