The reality show opens: we hope for Trump

The doubting investors always vote by money. Last week members of FRS actively competed in forecasts - practically all currencies both were consolidated at the strong levels or turned against the direction of December. Strong volatility remains - we wait for May's performance on Brexit, Draghi after the meeting of the ECB and Trump's performance already as the president - on Friday.

Would be naive to expect that Trump at the first press conference will answer, at least, a part of urgent questions instead of generating new uncertainty. The only question in which Trump was consecutive and made personnel appointments according to the declared line item is a foreign trade that obviously emphasizes a strong mercantile spirit of the USA.

Analysts consider that financial and tax plans of Trump`s administration can cause a short-term economic impulse - because of direct expenses, the consumption and investments inspired by a decrease in taxes, but in the long term the USA have to resist to inflation and debt problems. Besides, implementation of measures for the decrease in taxes can lead to a decrease in the sovereign credit rating of the USA because of even more serious increase in the American national debt.

Absence even the minimum comments on the program of the tax and budget stimulation of the American economy from election promises disappointed the market with the subsequent active sale of the dollar, growth of the stock indexes in Europe and the USA, also decline in yield of bonds of the US Treasure.

The Bank of England is ready to raise the economic estimations already the second time after Brexit. The release of new estimations is expected current week (at least - to Trump). According to unofficial data, growth at the level of 1.4% this year and achievement of growth of consumer prices at the target objective of 2% next quarter is expected.

The pound went against euro again though there are no serious reasons for this purpose - movement is provided with a regular market demand for the dollar. The Minister of Finance of Great Britain Hammond declared that there is no decision on access to the single market of Europe yet. Prime minister May will make the important speech on the next Tuesday concerning an exit of Great Britain from the EU, then, most likely, the pound will win back.

To sell pound at opening of an Asian session in the period of the minimum liquidity becomes tradition. This morning the next flash crash dropped GBP/USD for 1.5% to the area of annual minima. A basic reason - potentially hard line of British government at negotiations on a country exit from structure of the EU. At the weekend in Sunday Times article that Mae at the forthcoming negotiations with the EU is ready to refuse the single market to keep control over immigrant policy appeared. At the European session the pound can partially recover losses, however it is possible not to expect steady growth.

From other news it should be noted the following:

- The oil price already added more than 20% after the agreement on reducing production was signed by OPEC. Saudis are ahead of schedule on oil promises, at the same time the uncertainty in the relation of world amounts of reducing against the background of an increase in production by Iran, Libya and Nigeria only increases. The new administration of the USA has an excellent chance to completely change the oil market due to strategic sale of slate products and new import taxes. Nevertheless, for Saudi Arabia against the background of an exit to the international market and the forthcoming IPO Aramco such situation only advantageable, irrespective of a situation in slate oil production.

- Shareholders of UniCredit Bank SpA, the largest on the amount of assets in Italy, approved attraction of the supplementary capital in the amount of €13 billion by way of sale of new shares (last year their quotations failed for 45%!) among the existing shareholders of the bank. Also concluded the decision about the consolidation of the securities of UniCredit-10 will be transformed into one. The bank actively aims to grow the capital to conform to requirements of regulators, for this purpose strenuously gets rid of incidental assets, and also plans to sell a portfolio of the «bad» credits - for any price.

- China is in a fever - currency holdings decreased in 11 months of last year from $3,3 trillion to $3,05 trillion. The government hardly constrains capital outflow from the country − its currency SAFE regulator prohibited to analysts to publish negative outlooks for yuan, and banks − to disclose any information to prevent panic which can lead to further depreciation of the national currency. On Thursday night NBK declared checks of platforms selling Bitcoin, having dropped a rate of electronic currency almost for 30%. At the same time, SAFE closes up programs of the opening of the foreign markets to the Chinese investors. The special irony of the current situation is that not so long ago the IMF turned yuan into «dear» and a rather reliable member of SDR.

Friday, the 13th. The market in the fog: Yellen in the performance once again expressed confidence that the US economy feels «rather well» and no serious obstacles in the short term are expected. Time of a crowning comes. It is possible to expect that Trump will concentrate attention on creation of new workplaces in the USA as a priority of the policy. It is necessary to be afraid of notes of rather excessive growth of dollar exchange rate in relation to all currencies of the main trading partners of the USA. Also mentioning of the plan for investments into infrastructure as priorities isn't excluded that can lead to the small growth of dollar. If before an inauguration speech of Trump of profitability of 10-year treasury securities of the USA are on a minimum of January, then it is possible to expect growth of dollar after its performance.

The publication on growth of inflation of the prices of consumers will become the main data of the USA forthcoming week. This inflation isn't the main reference point of FRS, but the price performance in December will lead to adjustment of expectations of the market concerning time of the forthcoming increase in a rate of FRS.

On Friday morning China will publish the statistics block, but all attention of investors will be riveted on Trump's duel and Beijing. China will try to adjust dialogue with Trump's team at a forum in Davos on January 17-20 though official representatives of team of Trump won't be there, but unofficial Trump's advisers will visit Davos.

If investors continue to buy the dollar against the background of election promises of Trump and forecasts for the strengthening of the American economy, then the euro will receive the additional pressure upon internal inflation, much bigger, than the ECB expects. So far the euro continues to grow against the dollar, and positive industrial output in the eurozone provided additional support. But if the closing of positions on disappointment from Trump is slowed down, the common currency will quickly hand over positions, though the meeting of the ECB current week can create conditions (and opportunities!) to sell EUR/USD again. As always, demand will depend on Draghi's rhetoric, but any rather optimistical comment will cause growth even if the market focus will keep on the dollar.

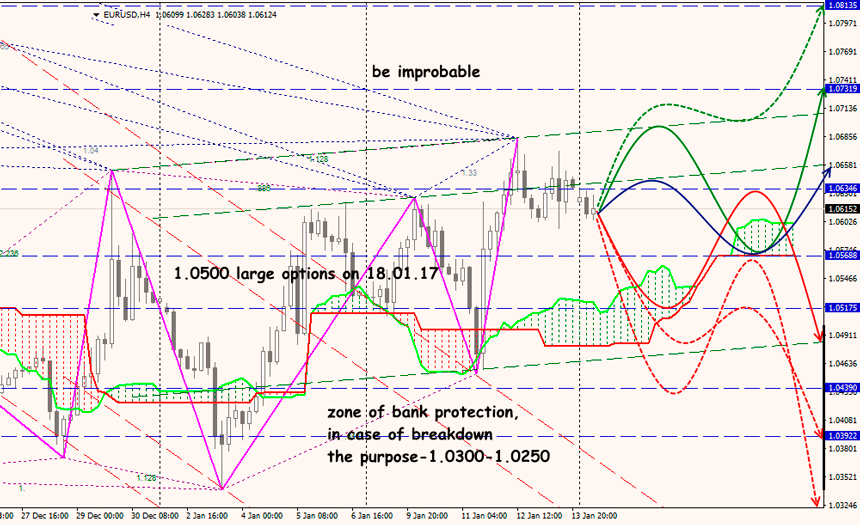

Technical Analysis EUR/USD

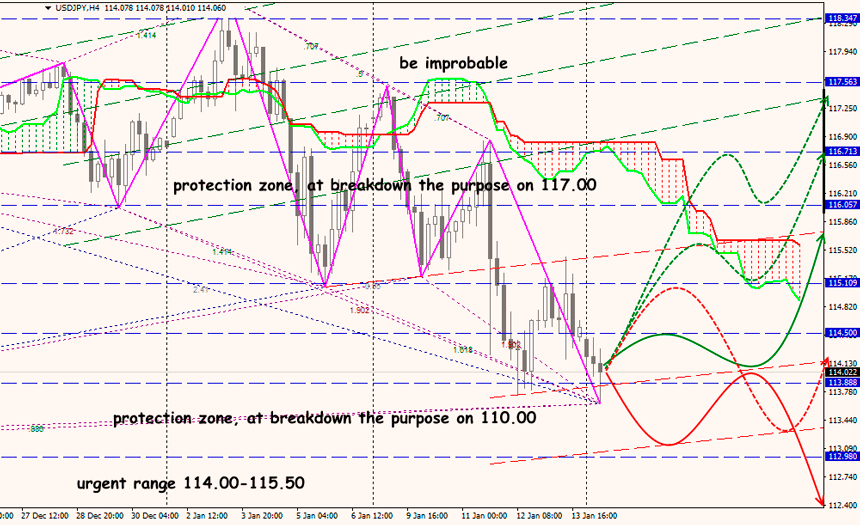

Technical Analysis USD/JPY