You didn't have time to purchase dollar?! Then we go to you!

In spite of the fact that increase in a rate was already pledged in the price, and FRS behaved exactly as it was expected, banal desire to collect stops before New Year caused several local disasters. Now reasonable doubts concerning a trumpoeconomic aren't heard against the background of wild dollar rally at all.

At a meeting of FOMC, the forgotten long ago scenario was realized. Usually in the case of an increase in a rate on federal funds also the discounted rate (for assistance to banks with a lack of reserves) automatically increases to hold a difference between them. The discounted rate shall be higher, than a rate on federal funds. Two separate press releases of FOMC have issued this time: the standard statement and additional in which data on increase in a discounted rate to 1.25% were placed. The decision is divided into two parts because also vote at two rates was separate.

Because of it, the markets almost didn't pay attention to forecasts of FOMC members, which inexplicably united in a consensus that even two increases in rates next year will be much, and promised three is a regular boasting. Especially if to consider that the cash team of Trump (generally from Goldman Sachs) already carries on a talk on the release of 50 and 100-year bonds. We enter reality in which Donald Trump will terrorize economy the budget incentives, and the Federal Reserve will continue to press against the stop on a pedal of incentives monetary.

The petard consists of interest rates issued by Yellen gave to the markets the reason, last this year, for the purchase of the American currency. Strong dollar - a chronic headache for the foreign borrowers who saved up multitrillion debts in the American currency. According to Bank for International Settlements, yet in the middle of 2016, the dollar loan issued to non-bank borrowers outside the USA reached $10.8 trillion. Nearly 30% of this amount was borrowed in emerging markets which are most subject to devaluation with a growth of rates in the States. Sharply capital outflow grows, increasing the purchasing power of Americans abroad, but at the same time, the external profit of large multinational corporations from the key stock indexes of the USA decreases.

Fall of the main assets was supported by key futures with the date of an expiration on December 15-16. Euro and yen were the most injured traditionally, negative dynamics on them, most likely, will proceed in the new year, and until the end of current you shouldn't wait for the serious movements.

Last week large players began to buy up euro to overlay the amounts spent for support of fall of common currency especially as last this year the American statistics left worse than expectations. In the evening on December 15, $24 billion «short» treasurer money came to the global stock market that looks an obvious negative for the dollar. Moreover, on the fixing of profit in the last week year the dollar can be corrected rather strongly against main currencies, but this its local decrease can be considered the invitation to new purchases.

In the advertized Agreement of OPEC winners and losers aren't determined yet. In due time the collapse of quotations didn't prevent OPEC to increase a share in the market because of the shale oil producers forced to depart, besides, Saudis accelerated implementation of the plans for disposal of oil dependence. In October of this year, the Kingdom for the first time entered the world markets of the equity, having sold bonds in the amount of $17.5 billion.

Now Riyadh expects that increase in prices caused by the agreement on reducing production will stir interest in an initial public offering of Saudi Arabian Oil Co state oil company. The income from the IPO of only 5% of these shares planned for 2018 shall constitute about $100 billion.

Producers of shale oil will also be able to use an increase in prices period in short term: if the OPEC keeps the promise and will really reduce production, the American shale oil producers will start to returning to the market again. Nevertheless, the effect of reducing is reduced by Libya which received privileges which resumed export deliveries, Nigeria also plans to increase shortly production to 2.2 million barrels a day, and uncontrollable Iran since January plans not to reduce, and to increase production by 7%. In other words, oil from the cartel doesn't decrease and arrives. The prices of popular brands of oil react respectively.

From other news we will note:

- In the letter to European Parliament Draghi recognized that «concerns about the availability of assets to pledge considerably grew» as total purchases of the ECB sharply reduce liquidity in the bond market. Leaders of the EU approved (the truth, without May's participation) procedural mechanisms of Brexit and confirmed commitment to the principles of the June communique. Great Britain will pay «tens of billions of euros» to the budget of the EU till 2020. FT reports that in a draft copy of clearing rules of the EU for 2017 Great Britain is already excluded from the euroclearing.

- After the next strikes, the parliament of Greece approved lump sum payment for pensioners with low pensions though this decision contradicts «Memorandum of understanding» with ESM. The IMF considers that the Greek debt is absolutely unstable and no amount of reforms can change a situation without essential debt relief. The IMF is ready to write off a part of a debt in case of accomplishment of the purposes on primary budget surplus for 2018 in the amount of 1.5%.

- The new government of Italy has assumed office, almost all ministers kept posts. It is already declared determination to invest €15 billion for support of a bank system. The head of European Commission Juncker promised new Italian «reformers» active support of the ECB again.

- The prices of state bonds of China showed the maximum week fall for more than seven years against the background of statements of U.S. FRS, depreciation of yuan and reduction of the liquidity. The yuan fell to an eight-year minimum.

- After the solution of NBS to leave a discount rate without changes, analysts of Commerzbank speak about a possibility of repeating the manipulations with franc similar to 15.01.2015. Switzerland buys euro again to weaken the franc, but without a tough reference point already. If the franc rate weighed on trade continues to grow (and devaluation of euro and policy of the ECB say that there is probability), NBS at some moment will stop interventions. The threat of sharp growth of franc sharply increases in the medium term and it is better to be ready to such succession of events.

Monday will be held on the Electoral College, which (in theory) may vote against the election of Trump. Official results will be announced on 6 January, but we can not exclude speculative reaction when information leakage. Thin market will begin in the evening of Thursday, 90% of this flat, in 10% cases more illogical move. Before the beginning of the fall of liquidity and thin market, as a rule, there is fixation of profit, but strong US data correction in the dollar's decline may begin later, including the first days of the New Year.

The empty macroeconomic calendar doesn't guarantee quiet trade - rather serious technical corrections are coming. The last trade week will be fulfilled completely - the calendar so disposed, but anyway we recommend to fix transactions to the middle of Friday, and on yen - on Thursday as on Friday Japan has already a rest.

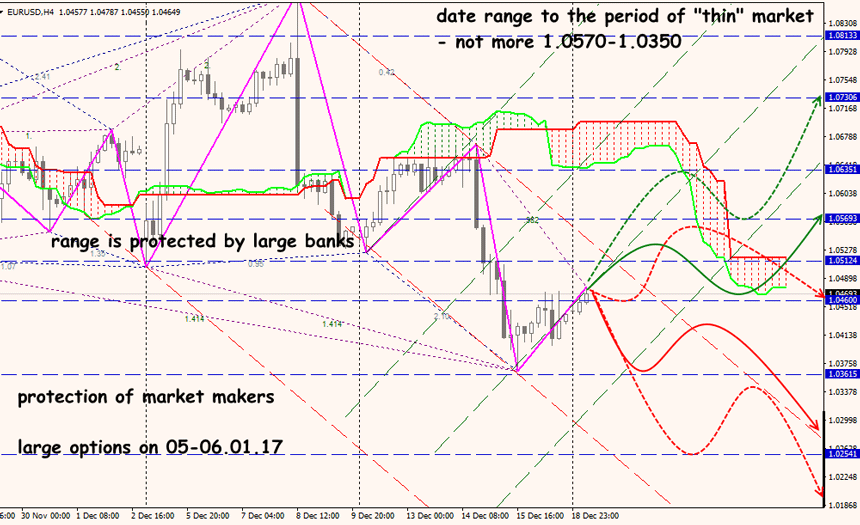

Technical Analysis EUR/USD

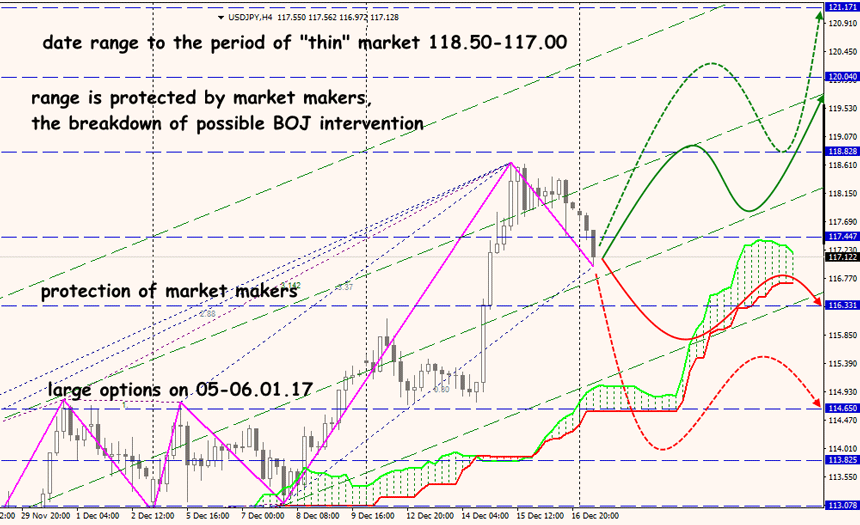

Technical Analysis USD/JPY